How Consumer Trust and Transparency Impact Insurance Purchasing Decisions brings to light the pivotal role that trust and transparency play in the insurance industry. In a world where consumers are increasingly discerning about their choices, understanding how these elements influence purchasing decisions is vital. With insurance being a significant financial commitment, the trustworthiness of companies and their transparent practices can make or break a customer’s decision.

By delving into the factors that contribute to building consumer trust, such as reliability and accountability, we can see that transparency in communication and practices creates an environment where consumers feel valued and understood. As we explore the interplay between these two crucial aspects, the importance of fostering trust and transparency becomes ever clearer in shaping the future of insurance.

The Importance of Consumer Trust in Insurance

In the competitive landscape of insurance, establishing consumer trust is paramount. Trust serves as the foundation of the relationship between insurance providers and their clients, influencing the purchasing decisions of potential customers. A high level of consumer trust not only facilitates smoother transactions but also fosters a sense of security and reliability in the services offered. Building consumer trust in insurance companies involves multiple factors that collectively enhance the overall customer experience.

Transparency in policies, clear communication, and consistent service delivery are crucial elements that contribute to this trust. When consumers feel well-informed and valued, they are more likely to engage with a brand and recommend it to others.

Factors Contributing to Building Consumer Trust, How Consumer Trust and Transparency Impact Insurance Purchasing Decisions

Several key factors play a significant role in fostering consumer trust within the insurance sector. Understanding these can help companies better align their strategies to meet customer expectations and enhance loyalty.

- Transparency in Pricing: Providing clear and comprehensive breakdowns of policy costs helps consumers feel more confident in their purchasing decisions. Hidden fees or ambiguous terms can lead to distrust and dissatisfaction.

- Honesty in Claims Handling: A straightforward claims process with transparent criteria reassures customers that they will be treated fairly and equitably when they need to file a claim.

- Consistent Customer Engagement: Regular communication through various channels, including emails, newsletters, and social media posts, keeps customers informed and engaged, reinforcing their trust in the brand.

- Positive Customer Reviews and Testimonials: Highlighting customer success stories and positive experiences can significantly influence potential buyers, as they often look for validation from their peers before making decisions.

Impact of Trust on Customer Loyalty and Retention

Trust has a profound impact on customer loyalty and retention in the insurance sector. When consumers feel assured about the integrity and reliability of their insurance provider, they are more likely to remain loyal to the brand. This loyalty translates into long-term relationships, leading to higher retention rates.The correlation between trust and loyalty can be illustrated through various statistics. Research shows that companies with high trust levels can experience up to a 50% increase in customer retention.

Additionally, trustworthy brands tend to enjoy a higher net promoter score, indicating that satisfied customers are more inclined to recommend the service to others.

“Trust is the lifeblood of customer relationships in the insurance industry; it transforms one-time buyers into lifelong advocates.”

Establishing and maintaining consumer trust should be a top priority for insurance companies, as it not only enhances customer satisfaction but also drives business growth. By prioritizing transparency and open communication, insurers can create a loyal customer base that thrives on confidence and reliability.

Transparency as a Key Factor in Insurance Purchases

In an era where consumer empowerment is at its peak, transparency has emerged as a cornerstone in the insurance sector. It is not just about offering policies; it is about building trust through clear communication and openness. Insurance companies that prioritize transparency are effectively engaging consumers, enhancing loyalty, and transforming purchasing behaviors.The concept of transparency in the insurance industry revolves around the clarity of information provided to consumers.

This includes clear explanations of policy terms, premium costs, claim processes, and any potential exclusions. By demystifying policy intricacies, insurers can foster a trust-based relationship with their clients. The importance of transparency cannot be overstated; it serves as a vital differentiator in a crowded marketplace.

Examples of Transparent Practices in Insurance

Transparent practices significantly enhance consumer confidence. Here are several examples of how insurance companies can adopt transparency in their operations:

- Clear Policy Documentation: Providing comprehensive documents that Artikel coverage details, exclusions, and terms in straightforward language.

- Accessible Customer Support: Establishing easily reachable customer service channels that can address queries without lengthy wait times.

- Transparent Pricing Structures: Offering a breakdown of how premiums are calculated, including any applicable fees or discounts, helps consumers understand their financial commitments.

- Regular Updates on Policy Changes: Informing customers of any changes to their policies or coverage options in a timely manner creates a sense of inclusion and trust.

- Feedback Mechanisms: Implementing systems where consumers can provide feedback on services and claim processes, which can be used to improve future experiences.

Transparent practices influence consumer perceptions significantly. When potential buyers are presented with clear and honest information, they are more likely to feel confident in their decisions. This confidence can lead to higher satisfaction rates and a greater likelihood of recommending the insurer to others. Furthermore, transparency in the claims process, where consumers are kept informed about the status of their claims, can significantly affect their loyalty to a brand.

“Transparency fosters trust; it is the bridge between the consumer and the insurer.”

Incorporating transparent practices not only enhances customer experiences but also positions insurance companies as leaders in an industry often viewed with skepticism. By prioritizing transparency, insurers can differentiate themselves, attract new customers, and cultivate long-term relationships based on trust and reliability.

The Relationship Between Trust, Transparency, and Consumer Behavior

The intricate connection between trust and transparency plays a vital role in shaping consumer behavior, particularly in the insurance industry. As customers navigate their options, they increasingly prioritize companies that embody these values, leading to significant implications for purchasing decisions. Understanding this relationship can help companies adapt their strategies to gain a competitive edge and foster lasting customer loyalty.Trust and transparency are interdependent; when one is compromised, the other often follows suit.

For instance, a lack of clear communication about policy terms, pricing structures, or claims processes can erode consumer trust, leading to hesitation or abandonment in purchasing decisions. Insurers who fail to provide comprehensive and straightforward information risk losing potential customers to competitors who prioritize transparency.

Impact of Inadequate Transparency on Consumer Trust

Inadequate transparency in insurance offerings can severely diminish consumer trust and influence purchasing behavior in detrimental ways. When consumers perceive a lack of openness, they may become skeptical about the insurer’s intentions, leading to a breakdown in trust. This skepticism can manifest in various ways:

Decreased Engagement

Consumers are less likely to engage with brands that do not clearly articulate their offerings, which can result in decreased interest in purchasing.

Increased Anxiety

The potential for hidden fees or unclear policy details can create anxiety among consumers, leading them to hesitate or abandon purchases.

Negative Word-of-Mouth

Unsatisfied customers who feel misled may share their experiences, damaging the insurer’s reputation and deterring new customers.To illustrate these points, consider the case of a well-known insurance provider that faced backlash due to unclear policy terms. The lack of transparency resulted in a significant drop in customer satisfaction ratings and a decline in new policy subscriptions, showcasing how critical openness is for maintaining consumer trust.

Comparative Case Studies of Insurance Companies

Examining case studies of insurance companies that excel in trust and transparency versus those that do not provides valuable insights into consumer behavior.

1. Example of High Trust and Transparency Company A has been recognized for its comprehensive policy disclosures and commitment to customer education. By providing easy-to-understand materials and accessible customer service, they have cultivated a loyal customer base, reflected in high retention rates and positive reviews. Their transparency about claims processes has also led to increased customer satisfaction and referrals.

2. Example of Low Trust and Transparency Company B, on the other hand, faced considerable challenges due to its opaque pricing strategies and elusive policy information. Consumers reported feeling misled, resulting in high complaint rates and a noticeable decline in market share. This case exemplifies the repercussions of ignoring transparency, underscoring how quickly trust can erode and affect purchasing decisions.By analyzing these contrasting scenarios, it’s clear that a commitment to transparency not only enhances consumer trust but also significantly influences purchasing behavior.

As the insurance landscape continues to evolve, the importance of these factors in driving consumer decisions cannot be overstated.

Strategies for Enhancing Trust and Transparency in Insurance

Building consumer trust and ensuring transparency are critical components for insurance companies aiming to enhance their market position. A well-structured plan to improve communication, customer service, and the adoption of technology can lead insurers to foster a more trustworthy relationship with their clients. Companies that prioritize these strategies not only enhance consumer confidence but also improve overall customer satisfaction and loyalty.

Improving Communication Transparency

Clear and effective communication is vital to enhancing transparency. Insurance companies can adopt the following strategies for improved customer communication:

- Regular Updates: Conduct regular updates through newsletters, emails, or dedicated portals to keep clients informed about policy changes, claims processes, and any relevant legislative developments.

- Clear Policy Language: Simplify the language used in policy documents to ensure clients fully understand their coverage, exclusions, and obligations.

- Interactive Online Platforms: Develop user-friendly online portals that allow customers to access their information, ask questions, and engage with representatives easily.

- Transparent Pricing Models: Clearly explain pricing structures, including factors affecting premiums and potential discounts, to alleviate confusion and mistrust.

Building Trust Through Customer Service and Claims Processing

Trust can significantly be built through exemplary customer service and efficient claims processing. Insurers should focus on the following methods:

- Responsive Support: Provide multiple channels for customer support including phone, chat, and email, ensuring that representatives are trained to handle inquiries with empathy and efficiency.

- Claims Transparency: Keep clients informed about the status of their claims throughout the processing stages, minimizing surprises and uncertainty.

- Proactive Problem Resolution: Implement a system for identifying potential issues early on and addressing them proactively, which helps in building customer confidence.

- Feedback Mechanisms: Establish robust feedback channels where customers can share their experiences and suggestions, and ensure that this feedback is acted upon.

The Role of Technology in Enhancing Trust and Transparency

Technology plays a pivotal role in fostering both trust and transparency within the insurance sector. Insurers can leverage technology through the following avenues:

- Data Analytics: Utilize data analytics to provide personalized insurance solutions, which can further enhance customer satisfaction and trust.

- Blockchain Technology: Implement blockchain for claims management to ensure that all transactions are secure, transparent, and immutable, thus reducing fraud.

- AI Chatbots: Deploy AI-driven chatbots that offer 24/7 support, answering queries instantly and providing consistent information, which fosters trust in the insurer’s reliability.

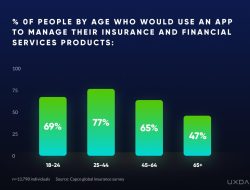

- Mobile Apps: Create mobile applications that allow customers to manage their policies, file claims, and access information swiftly, enhancing the overall user experience.

Consumer Perspectives on Trust and Transparency

In the competitive insurance landscape, consumer trust and transparency play pivotal roles in shaping purchasing decisions. Understanding consumer perspectives helps insurers address concerns, bridge gaps, and foster stronger relationships. Recent surveys reveal that trust is a cornerstone for consumers when selecting an insurance provider, significantly influencing their choices and loyalty.Surveys conducted by various market research firms indicate that a large segment of consumers believes that transparency correlates directly with the level of trust they place in an insurance company.

Many consumers perceive insurance companies as opaque, leading to skepticism regarding policy terms, pricing, and claims processes. Addressing these misconceptions is crucial for building a trustworthy reputation.

Insights from Consumer Surveys

Consumer surveys reveal valuable insights into how trust and transparency impact purchasing decisions. A significant finding is that approximately 70% of consumers prefer insurers that clearly communicate policy details without hidden fees. Furthermore, 65% express a need for accessible claims processes that provide real-time updates. Transparency in these areas can bolster trust and encourage consumer loyalty.

Common Misconceptions About Insurance Companies

Many consumers hold misconceptions about insurance companies that can hinder their purchasing decisions. For instance, a prevalent belief is that insurers prioritize profit over customer well-being. This notion can be countered through effective communication of commitment to customer service and support during claims.Another common misconception is the belief that all insurance policies are fundamentally the same, leading to confusion. Insurers can address this by offering clear comparisons and explanations of policy differences, emphasizing unique benefits and tailored coverage options.

Consumer Expectations Regarding Transparency

Understanding consumer expectations about transparency is essential for insurers aiming to enhance trust. Here are key expectations identified by consumers:

- Clear communication of policy terms and conditions.

- Regular updates on claims status and processing timelines.

- Transparent pricing structures without hidden fees.

- Easy access to customer service representatives for inquiries and support.

- Educational resources that explain complex insurance jargon.

Addressing these expectations creates a foundation for improved consumer trust. By focusing on transparency, insurers can cultivate a more informed and confident customer base.

“Transparency is not just about sharing information; it’s about creating a relationship built on trust.”

The Role of Regulations in Promoting Transparency and Trust

In an industry where consumer confidence is paramount, regulations play a crucial role in ensuring transparency and fostering trust within the insurance sector. Regulatory frameworks establish standards that insurance companies must adhere to, creating an environment where consumers can make informed decisions. This foundation of trust is vital for insurers as it directly influences consumer purchasing behavior and brand loyalty.Compliance with regulations is not merely a legal obligation; it enhances consumer trust by ensuring that companies operate with integrity and provide clear information about their products and services.

Regulatory oversight helps to mitigate risks of fraud and misrepresentation, thus providing protection for consumers. Consequently, the presence of robust regulations can serve as a competitive advantage for insurers, enabling them to differentiate themselves in a crowded marketplace.

Key Regulations and Their Implications for Insurance Transparency

Understanding the specific regulations that impact transparency in the insurance industry is essential for both insurers and consumers. Here is a table outlining some of the most significant regulations and their implications for transparency practices within insurance companies:

| Regulation | Description | Implications for Transparency |

|---|---|---|

| Gramm-Leach-Bliley Act (GLBA) | Requires financial institutions, including insurance companies, to explain their information-sharing practices to consumers. | Enhances transparency by mandating clear disclosure of how consumer data is collected and used. |

| Insurance Information and Privacy Protection Act | Governs the collection and sharing of personal information by insurers. | Encourages transparency in data handling and gives consumers control over their personal information. |

| Health Insurance Portability and Accountability Act (HIPAA) | Sets standards for protecting sensitive patient health information. | Fosters trust by ensuring that health-related data is handled with strict confidentiality. |

| Solvency II Directive | A European regulatory framework for insurance firms that focuses on risk management and financial stability. | Enhances consumer trust by ensuring that insurers maintain sufficient capital to meet their obligations. |

| Unfair Trade Practices Act | Prohibits unfair or deceptive acts in the insurance industry. | Promotes transparency by holding insurers accountable for their advertising and sales practices. |

“Regulatory compliance not only protects consumers but also enhances the reputation and reliability of insurance companies.”

By adhering to these regulations, insurance companies can enhance their transparency practices, thereby building greater trust with consumers. This fosters a more informed and secure marketplace, where consumers feel confident in their insurance purchasing decisions.

Case Studies of Successful Transparency Initiatives

In the evolving landscape of the insurance industry, transparency is a crucial element that significantly influences consumer trust and purchasing decisions. Numerous insurance companies have implemented innovative transparency initiatives that not only enhance consumer confidence but also reshape their market positioning. This section delves into notable case studies showcasing successful transparency efforts, analyzing outcomes and extracting valuable lessons for other companies.

Progressive Insurance’s Snapshot Program

Progressive Insurance introduced its Snapshot program, a usage-based insurance initiative designed to provide personalized rates based on driving behavior. By using a telematics device, customers can track their driving habits, which enables them to receive discounts for safe driving. This initiative exemplifies transparency by allowing consumers to understand how their behavior directly impacts their premiums.The outcomes of the Snapshot program have been significant:

- Increased customer engagement through real-time data sharing.

- Enhanced trust as customers gain insight into the factors affecting their premiums.

- A reported 30% increase in customer retention rates, indicating positive purchasing behavior as consumers feel more in control of their insurance costs.

“Transparency in insurance isn’t just about providing information; it’s about empowering consumers.”

Geico’s Easy-to-Understand Policy Breakdown

Geico has made strides in simplifying the insurance purchasing process with its user-friendly online platform that breaks down insurance policies into clear, digestible segments. By employing straightforward language and visual aids, Geico enhances consumer comprehension while minimizing the intimidating jargon often associated with insurance.This initiative has resulted in:

- A boost in online policy purchases by approximately 25%.

- Higher customer satisfaction scores, with many clients appreciating the clarity provided.

- Strengthened reputation as a transparent insurer, leading to a notable increase in brand loyalty.

Allstate’s Claims Transparency Dashboard

Allstate launched a claims transparency dashboard that allows policyholders to track the status of their claims in real time. This tool offers updates at every stage, giving customers visibility into the claims process, which can often be a black box for consumers.The effects of this initiative include:

- Improved customer trust, as individuals feel more informed and less anxious about their claims.

- A decrease in call center inquiries by approximately 40%, as customers no longer need to seek updates through traditional channels.

- An increase in positive customer feedback regarding the claims process, contributing to a stronger brand image.

Lessons Learned from Transparency Initiatives

The insights gathered from these case studies underline several key takeaways for insurance companies aiming to implement similar initiatives:

Consumer Empowerment

Providing tools and resources that allow consumers to take control of their insurance experience fosters trust and satisfaction.

Clarity Over Complexity

Simplifying communications and breaking down policies into understandable components can attract and retain clients.

Continuous Engagement

Regular updates and real-time tracking can enhance customer relationships, reducing frustrations and improving overall perceptions of the insurer.By adopting these practices, insurance companies can not only boost consumer trust but also significantly influence purchasing behaviors, positioning themselves as leaders in a highly competitive market.

Future Trends in Consumer Trust and Transparency: How Consumer Trust And Transparency Impact Insurance Purchasing Decisions

As the insurance landscape continues to evolve, so too do consumer expectations around trust and transparency. The increasing digitization of services and the growing demand for ethical practices are steering the future of the insurance industry toward a more consumer-centric approach. Companies that prioritize these elements are not only likely to enhance customer satisfaction but also gain a competitive edge in a crowded market.Emerging technologies are anticipated to play a significant role in reshaping consumer trust levels.

Innovations such as blockchain, artificial intelligence, and big data analytics are set to revolutionize how information is shared and processed within the insurance sector. These technologies promise greater security, real-time access to policy details, and more personalized interactions, all of which contribute to building a stronger foundation of trust.

Impact of Emerging Technologies on Consumer Trust

The rise of advanced technologies brings forth significant implications for consumer trust in insurance. By leveraging these innovations, insurers can enhance transparency and accountability, thereby fostering a more trustworthy environment. Key areas affected by emerging technologies include:

- Blockchain Technology: By offering a decentralized and immutable ledger, blockchain ensures that all transactions are transparent and traceable. This transparency can lead to an increase in consumer confidence as they can verify the legitimacy of policies and claims.

- Artificial Intelligence: AI can analyze consumer behavior and preferences, allowing insurers to provide tailored coverage options. When consumers feel understood and valued, their trust in the provider increases dramatically.

- Big Data Analytics: The ability to gather and analyze large sets of data enables insurers to offer personalized services. Transparency in how this data is used can demystify processes for consumers, fostering a sense of trust.

- Chatbots and Virtual Assistants: These tools can provide immediate answers to consumer inquiries, ensuring that information is readily available. Quick access to information reinforces transparency.

“Trust is built in small moments. It is earned through consistent delivery and transparency over time.”

To meet the future demands for transparency, the insurance industry must undergo significant evolution. Adopting transparent communication practices, providing clear terms and conditions, and ensuring that customers have easy access to their policy information will be essential. Furthermore, companies should actively engage consumers in the dialogue about trust and transparency, soliciting feedback and making adjustments based on their insights. By embracing a culture of transparency, insurers will not only satisfy existing customers but also attract new ones in an increasingly conscious market.