Consumer Trust and Transparency as Key Drivers in Insurance Purchases are essential elements that redefine how consumers engage with insurance providers. In a marketplace crowded with options, trust serves as the foundation for purchasing decisions, while transparency sheds light on the often-complex world of insurance policies. As customers become more informed and selective, the need for insurers to cultivate trust and foster transparent communication has never been more critical.

By focusing on building consumer trust through reliability and open communication, insurance companies can not only enhance customer loyalty but also differentiate themselves in a competitive landscape. Successful examples of insurers who prioritize these values illustrate the profound impact of transparency, from clear policy explanations to honest customer interactions, paving the way for a robust relationship with clients.

Importance of Consumer Trust in Insurance: Consumer Trust And Transparency As Key Drivers In Insurance Purchases

Consumer trust plays a pivotal role in the insurance industry, serving as the foundation for successful transactions and long-term relationships. In an environment where policies are often complex and claims processes can be daunting, consumers seek assurance that their chosen insurer will act in their best interests, especially during critical moments. The level of trust a customer has in an insurance provider directly influences their purchasing decisions and overall satisfaction.The relationship between trust and customer loyalty in the insurance sector cannot be overstated.

When customers feel confident in their insurance provider, they are more likely to remain loyal, renew policies, and even recommend the insurer to others. Trust fosters a sense of security, encouraging clients to engage more deeply with their provider. Research shows that companies with a high trust rating experience lower churn rates, creating a more stable customer base.

Examples of Successful Trust-Building in Insurance

Establishing and maintaining consumer trust is not just beneficial, but essential. Several insurance companies exemplify strategies that have effectively cultivated trust among their clientele. Here are key characteristics and actions taken by these companies:

- Transparency in Communication: Companies like USAA are renowned for their clear communication, ensuring customers fully understand their policies. This practice eliminates confusion and builds confidence in their services.

- Responsive Customer Service: Organizations such as Geico have prioritized customer service, offering 24/7 support to address client concerns promptly. This responsiveness enhances trust, as clients feel valued and supported.

- Positive Claims Experiences: Progressive has invested heavily in streamlining its claims process. By simplifying how clients submit claims and providing regular updates, they have created a reputation for reliability during critical times.

- Community Engagement: State Farm is known for its community initiatives, which not only enhance its public image but also demonstrate a commitment to customer welfare beyond just financial transactions.

“Trust isn’t just a word; it’s the cornerstone of every successful insurance relationship.”

Through these strategies, insurance companies can effectively build a strong foundation of trust with their customers, leading to enhanced loyalty, increased sales, and positive word-of-mouth referrals, which are vital in an increasingly competitive market.

Factors Enhancing Transparency in Insurance

Transparency in the insurance industry is essential for building consumer confidence and fostering long-lasting relationships. By embracing transparency, insurance companies can simplify their processes, making it easier for consumers to understand policies and make informed choices. This not only enhances the customer experience but also cultivates trust, which is a vital component in the decision-making process for purchasing insurance products.Several key factors contribute to increased transparency in insurance.

These include clear communication of policy terms, accessibility of information, and the use of technology to streamline processes. Insurance providers that prioritize these factors often set themselves apart in a competitive market. Understanding these elements can help both consumers and providers create a more transparent insurance landscape.

Clear Communication of Policy Terms

Effective communication is fundamental in ensuring that consumers comprehend the products they are purchasing. Insurance companies can enhance transparency by adopting the following practices:

- Utilizing simplified language in policy documents to avoid jargon and legal complexities.

- Providing detailed explanations of coverage options and exclusions, allowing consumers to understand what is and isn’t covered.

- Creating visual aids, such as infographics, to illustrate policy features and benefits clearly.

For instance, leading insurers like Lemonade provide a user-friendly interface that allows customers to easily navigate through policy terms, making the information accessible and understandable.

Accessibility of Information

Making information readily available is another crucial factor in enhancing transparency. Insurance providers can adopt these methods:

- Offering online quotes that are easy to obtain, allowing customers to compare options without the need for extensive discussions.

- Maintaining dedicated customer service teams that can answer policy inquiries and provide clarification promptly.

- Implementing educational resources, such as FAQs and blogs, that address common concerns and explain insurance concepts.

Progressive Insurance exemplifies this approach by providing extensive resources on their website, empowering consumers to make informed decisions without unnecessary hurdles.

Use of Technology to Streamline Processes

Incorporating technology into insurance processes not only enhances efficiency but also improves transparency. Companies can leverage technology in the following ways:

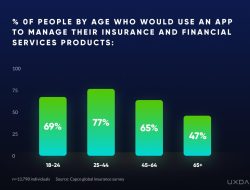

- Using mobile apps to allow customers to manage their policies and claims in real-time, providing instant access to information.

- Employing automated systems to update customers on the status of claims and policy changes, ensuring they stay informed.

- Integrating AI-driven chatbots to assist customers with immediate questions and concerns, further enhancing the communication process.

For example, Geico has capitalized on technology by offering a comprehensive mobile app that allows users to view their policies, file claims, and receive updates, making insurance management more transparent and user-friendly.

“Transparency in insurance is not just a regulatory requirement; it is a strategic advantage that builds trust with consumers.”

The Role of Communication in Building Trust

Effective communication is the cornerstone of building consumer trust in the insurance industry. In an environment often perceived as complex and opaque, clear and transparent communication strategies allow insurance companies to establish strong relationships with their clients. By fostering an atmosphere of openness, companies not only enhance consumer confidence but also differentiate themselves in a competitive marketplace.Communication strategies in insurance should focus on clarity, consistency, and accessibility.

By employing these principles, companies can demystify insurance products, making it easier for consumers to understand their options and make informed decisions. Companies that prioritize effective communication are more likely to gain and maintain consumer trust, leading to long-term relationships and customer loyalty.

Best Practices for Delivering Clear and Concise Information

Delivering information about insurance products in a clear and concise manner is vital for fostering trust. Transparency regarding terms, conditions, and pricing enables consumers to appreciate the value of their policies. Here are best practices to enhance clarity in communication:

- Utilize Plain Language: Avoid jargon and technical terms that may confuse consumers. Use everyday language to explain policy details.

- Visual Aids: Incorporate charts and infographics to visually represent complex information, making it more digestible.

- Summarize Key Points: Provide concise summaries of important information at the beginning and end of documents to highlight essential details.

- FAQs Section: Develop a well-structured FAQ section addressing common concerns and queries to preemptively answer consumer questions.

- Regular Updates: Ensure consumers receive timely updates on policy changes, claims processes, or any other relevant information to keep them informed.

Guide for Developing Transparent Communication Plans

Creating a transparent communication plan tailored for insurance agencies is imperative to build consumer trust. A well-structured plan should incorporate the following elements:

- Define Objectives: Clearly Artikel the goals of the communication plan, such as increasing consumer understanding or improving engagement.

- Target Audience: Identify the demographics and needs of your consumers to tailor messages effectively. Understanding their concerns helps in addressing them directly.

- Choose Effective Channels: Select communication channels that best reach your audience, such as email newsletters, social media, or in-person seminars.

- Content Strategy: Develop a content calendar that Artikels topics, timelines, and formats for communication, ensuring consistent messaging.

- Feedback Mechanism: Incorporate methods for gathering consumer feedback to continuously improve communication strategies and address emerging concerns.

“Transparency breeds trust. The more information consumers have, the more confident they feel in their choices.”

Impact of Digital Transformation on Trust and Transparency

Digital transformation has become a pivotal force in reshaping how consumers perceive trust and transparency in the insurance industry. With the rise of digital tools and platforms, consumers now have unprecedented access to information, enabling them to make more informed decisions. This shift enhances consumer confidence, allowing insurance companies to build stronger relationships with their clients through transparency and accountability.The integration of digital technology has fundamentally shifted the dynamics of trust in the insurance purchasing process.

Consumers today expect seamless interactions, real-time information, and clear communication from their insurance providers. By leveraging digital tools, insurance companies can demystify policies, clarify complex terms, and offer a level of transparency that was previously unattainable.

Data Analytics Enhancing Transparency and Trust

Data analytics plays a crucial role in fostering transparency and building trust during the insurance purchasing process. By analyzing consumer data, companies can tailor their offerings, ensuring that customers receive personalized policies that meet their specific needs. This approach not only enhances the consumer experience but also establishes a foundation of trust through informed decision-making.The following points illustrate how data analytics can enhance transparency in the insurance industry:

- Real-time Insights: Data analytics enables insurers to provide up-to-date information on policy terms, pricing, and claims status, fostering a sense of trust through transparency.

- Risk Assessment: Advanced algorithms analyze consumer data to accurately assess risk, ensuring fair pricing and instilling confidence in policyholders.

- Fraud Detection: Enhanced analytics help in identifying fraudulent claims quickly, reassuring consumers that their interests are protected.

- Customer Feedback: Analyzing consumer feedback helps in refining services and products, demonstrating that insurers are responsive to consumer needs.

Examples of Successful Digital Transformations, Consumer Trust and Transparency as Key Drivers in Insurance Purchases

Insurance companies that have embraced digital transformation demonstrate how trust and transparency can be significantly improved. These organizations have implemented innovative strategies that not only engage consumers but also elevate their confidence in the insurance process.Prominent examples include:

- Progressive Insurance has incorporated telematics technology, allowing consumers to track their driving behavior through mobile apps while providing personalized discounts based on their driving habits. This transparency in pricing fosters trust.

- Allstate’s “Drivewise” program uses mobile technology to provide feedback on driving habits, encouraging safer driving while also allowing users to earn rewards. This initiative emphasizes transparency and builds a trusting relationship with customers.

- State Farm’s use of artificial intelligence chatbots for customer service significantly reduces response times and enhances clarity in communication, instilling further trust among policyholders.

Regulatory Framework and Consumer Trust

In the insurance industry, a robust regulatory framework plays a pivotal role in fostering consumer trust and enhancing transparency. Regulations are designed to protect consumers from unethical practices and to ensure that insurance companies operate within a framework that prioritizes the interests of policyholders. By establishing clear guidelines and standards, regulatory bodies help create an environment where consumers feel safe and informed when making insurance purchasing decisions.One of the key ways regulations promote transparency and trust in the insurance market is through the enforcement of disclosure requirements.

Insurance companies are mandated to provide clear and comprehensive information about policy terms, coverage details, and pricing structures. This transparency allows consumers to compare different offerings and make informed choices. Furthermore, regulatory standards serve to hold insurers accountable for their claims handling processes, ensuring that disputes are resolved fairly and promptly.

Regulatory Standards Impacting Insurance Practices

Various regulatory standards affect how insurance firms operate and their approach to consumer trust. Understanding these standards is essential for both insurers and consumers, as they directly influence the level of transparency and accountability in the market. Some of the prominent regulatory frameworks include:

- Solvency II: This EU directive focuses on the financial stability of insurance companies, requiring them to maintain adequate capital reserves to meet future policyholder obligations. By ensuring that insurers are financially sound, consumer confidence is bolstered.

- Insurance Distribution Directive (IDD): This regulation mandates that insurance providers offer clear and comprehensive information about their products, ensuring that consumers understand what they are purchasing. It emphasizes the importance of consumer protection in the sales process.

- Fair Credit Reporting Act (FCRA): In the U.S., this act regulates how insurers can use credit information to determine premiums. It promotes fair treatment of consumers and enhances trust by ensuring that credit scores are used responsibly and transparently.

- Consumer Financial Protection Bureau (CFPB): This U.S. agency oversees financial products and services, including insurance. The CFPB aims to ensure that consumers receive accurate and transparent information, thereby enhancing trust in financial transactions.

Case studies illustrate how regulatory compliance has positively impacted consumer trust in specific insurance firms. For instance, a leading European insurer implemented the Solvency II framework effectively and communicated its financial health transparently to clients. As a result, the company saw a 20% increase in customer retention rates, highlighting the direct correlation between regulatory compliance and consumer trust.Another example can be observed with a U.S.-based insurance firm that adhered strictly to the guidelines set forth by the CFPB.

The firm revamped its communication strategy to ensure clarity in pricing and policy details. This commitment to transparency not only led to a significant reduction in complaints but also improved customer satisfaction ratings by over 30%. Such examples reinforce the notion that a strong regulatory framework not only protects consumers but also enhances the overall reputation of insurance providers in the marketplace.

Regulatory compliance fosters a culture of transparency, ultimately building lasting consumer trust.

Consumer Education and Empowerment

Educating consumers about insurance products is essential to building trust and enhancing transparency within the insurance industry. An informed consumer is better equipped to make decisions that cater to their individual needs and financial circumstances. This knowledge not only empowers them but also fosters a more open and accountable relationship with insurers, ultimately enhancing the consumer experience.Effective consumer education programs must be carefully structured to provide relevant and digestible information.

Insurance companies can implement a comprehensive framework to facilitate consumer education initiatives that address various aspects of insurance products. The framework can include the following key components:

Framework for Implementing Consumer Education Programs

A well-rounded consumer education program includes several critical elements that engage and inform consumers. Here are some foundational aspects that insurance companies can incorporate:

- Accessible Educational Resources: Develop user-friendly materials such as brochures, infographics, and e-learning modules that explain insurance concepts in simple terms.

- Workshops and Webinars: Host interactive sessions led by industry experts to provide insights on specific insurance products, helping consumers understand the benefits and limitations.

- Personalized Guidance: Offer one-on-one consultations where consumers can discuss their specific needs with knowledgeable agents who can guide them through the available options.

- Online Tools and Calculators: Create digital platforms where consumers can simulate insurance scenarios, helping them visualize how different policies can impact their financial situation.

Consumer empowerment strategies also play a significant role in enhancing trust and transparency. Insurance organizations can adopt successful approaches that have proven effective in other sectors.

Successful Strategies for Empowering Consumers in Insurance Decisions

To foster consumer empowerment, organizations can implement several strategies that have demonstrated success in engaging and informing customers:

- Transparency Initiatives: Provide clear, comprehensive information about policy terms, pricing structures, and claims processes, enabling consumers to make informed choices.

- Feedback Mechanisms: Establish channels for consumer feedback to understand their needs and concerns better. This not only informs product development but also demonstrates that the company values consumer input.

- Community Engagement: Participate in local events and community outreach programs to build relationships and raise awareness about insurance products and services.

- Collaboration with Educational Institutions: Partner with schools and universities to integrate insurance education into their curricula, promoting financial literacy from an early age.

Empowered consumers are more likely to engage positively with insurance providers and make informed decisions that benefit their financial well-being.

Implementing these strategies creates a more informed consumer base, positioning companies as trustworthy and transparent entities within the insurance landscape.

Measuring Consumer Trust and Transparency Effectively

In the ever-evolving insurance landscape, accurately measuring consumer trust and transparency is vital for companies aiming to sustain and grow their market share. Effective metrics and methodologies not only provide insights into customer satisfaction but also highlight areas for improvement, ultimately fostering a stronger relationship between insurers and their clients.To gauge consumer trust in insurance companies, unique metrics and indicators come into play.

These measures can provide quantifiable data, enabling organizations to assess their performance in building trust and maintaining transparency.

Metrics and Indicators for Consumer Trust

Understanding and implementing the right metrics is essential in measuring consumer trust. Here are key indicators that can be effectively utilized:

- Net Promoter Score (NPS): This score reflects customer loyalty and the likelihood of recommending the company to others.

- Customer Satisfaction Score (CSAT): A direct measure of customer satisfaction post-interaction, providing immediate feedback on specific experiences.

- Customer Effort Score (CES): This metric gauges how easy or difficult it is for customers to obtain support or information, impacting overall trust.

- Trust Index Surveys: Custom surveys that assess various aspects of trust, including perceived fairness, reliability, and transparency in communication.

Analyzing consumer sentiment regarding trust in insurance purchases requires a structured approach that combines qualitative and quantitative data. The integration of these metrics aids in forming a comprehensive view of how consumers perceive the reliability of their insurers.

Tools and Methodologies for Feedback Collection

To collect valuable feedback regarding transparency, employing a variety of tools and methodologies is crucial. These approaches can effectively capture consumer sentiments and opinions:

- Online Surveys: Utilizing platforms such as SurveyMonkey or Google Forms allows for easy distribution and analysis of customer feedback.

- Focus Groups: Conducting in-depth discussions with selected consumers provides qualitative insights into their perceptions of trust and transparency.

- Social Media Monitoring: Observing social media channels for customer comments and reviews can reveal real-time sentiments and experiences.

- Customer Feedback Forms: Implementing feedback forms on websites or mobile apps encourages users to share their thoughts directly after interactions.

The combination of these tools creates a holistic view of consumer perceptions, enabling insurers to adapt their strategies accordingly.

Analyzing Consumer Sentiment

A structured approach to analyzing consumer sentiment involves several key steps. By following a systematic process, insurance companies can draw meaningful insights from the collected data.

- Data Collection: Gather data from the various tools previously mentioned to accumulate a diverse range of consumer feedback.

- Sentiment Analysis: Utilize text analysis tools to evaluate qualitative data, categorizing sentiments as positive, negative, or neutral.

- Trend Identification: Look for notable patterns in consumer feedback that point to prevalent issues or areas of trust enhancement.

- Action Planning: Develop strategies based on insights, addressing trust gaps and enhancing transparency to improve customer relations.

By implementing these structured methodologies, insurance companies can effectively measure and enhance consumer trust and transparency, ultimately leading to stronger customer loyalty and satisfaction.

Building Long-term Relationships through Trust

In the competitive landscape of the insurance industry, establishing long-term relationships with consumers is essential for sustained success. Trust and transparency serve as the foundation for these relationships, significantly influencing customer loyalty and retention. Companies that prioritize building trust not only see higher customer satisfaction but also cultivate a loyal customer base that advocates for their brand.To effectively build and maintain long-term relationships, insurance providers can implement several strategies aimed at fostering trust and transparency.

These strategies focus on open communication, consistent engagement, and the creation of loyalty programs that reinforce consumer trust over time.

Strategies for Building Long-term Relationships

Creating lasting relationships requires a multifaceted approach that includes proactive communication and effective engagement. Below are key strategies that insurance companies can adopt:

- Regular Communication: Maintain an ongoing dialogue with policyholders through newsletters, email updates, and personalized messages. This keeps consumers informed and engaged, fostering a sense of connection.

- Transparency in Processes: Clearly Artikel policy details, claims processes, and service expectations. Providing easy access to information helps consumers feel more secure and informed about their choices.

- Customer Feedback Mechanism: Implementing surveys and feedback loops allows consumers to voice their opinions, ensuring they feel heard and valued. This can lead to product improvements based on actual customer needs.

- Personalized Interactions: Tailor communications and services to individual customer profiles. Using data analytics to understand consumer preferences enhances the relationship and demonstrates care for their unique circumstances.

- Proactive Engagement: Reach out to customers not just during policy renewals but also during significant life events, such as births or home purchases, offering tailored products and services that fit their changing needs.

Loyalty Programs that Reinforce Trust

Loyalty programs are an effective way to reward long-term customers and reinforce their trust in a brand. These programs can take various forms, providing tangible benefits that resonate with policyholders. Examples include:

- Discounts on Renewals: Offering discounts for policy renewals rewards loyalty, encouraging customers to stay with the insurer long-term.

- Referral Bonuses: Incentivizing customers to refer friends and family can cultivate a community of trust, as recommendations from loved ones often hold more weight.

- Exclusive Access: Providing loyal customers with early access to new products or services enhances their feeling of being valued and keeps them engaged.

- Wellness Programs: Initiatives that promote healthy lifestyles, such as discounts on gym memberships or wellness apps, show a commitment to the customer’s overall well-being, further solidifying the relationship.

- Claim-Free Rewards: Offering incentives for claim-free years not only promotes responsible behavior but also builds confidence in the insurer’s reliability and integrity.

Building long-term relationships through trust in the insurance industry is a strategic investment that pays dividends. By fostering transparency and maintaining ongoing communication, insurers can cultivate loyal customers who feel valued and understood, ultimately driving business success through lasting partnerships.