How Consumer Behavior Influences the Marketing of Financial Investment Products is a pivotal inquiry into the dynamic interplay between consumer psychology and investment strategies. As the financial landscape evolves, understanding the motivations and behaviors of consumers becomes essential for marketers aiming to effectively connect with potential investors. This exploration reveals the underlying psychological factors, demographic influences, and social dynamics that shape investment choices, ultimately guiding marketers in crafting compelling narratives that resonate with their target audiences.

By delving into the nuances of consumer behavior, we uncover critical insights into how trust, social proof, and behavioral biases play substantial roles in the marketing of financial products. From the impact of economic conditions to the significance of digital marketing strategies, this discussion offers a comprehensive overview of the strategies that can elevate the marketing of financial investment products while aligning with consumer expectations and ethical standards.

Understanding Consumer Behavior in Financial Investments

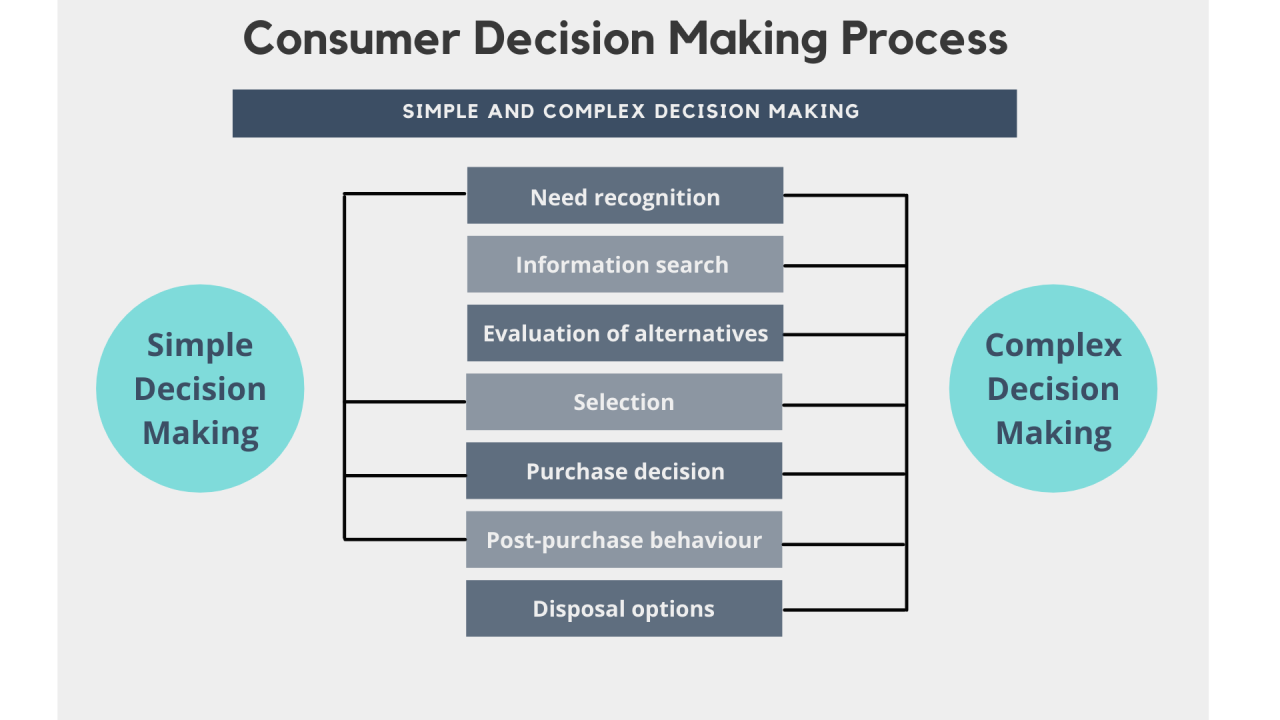

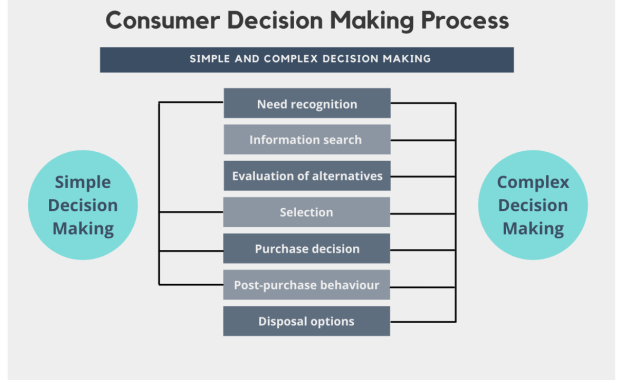

Consumer behavior plays a pivotal role in the financial investment landscape, influencing how individuals and institutions make decisions regarding where to allocate their resources. This understanding not only helps financial institutions tailor their products but also enables investors to make informed choices based on their personal circumstances and market conditions. By examining the psychological and demographic factors that impact investors, we can gain valuable insights into the dynamics of financial markets.The concept of consumer behavior encompasses the study of how individuals make decisions to spend their available resources, particularly in the context of financial investments.

Investors often rely on a combination of emotional, cognitive, and social factors when navigating the complex world of financial products. Understanding these variables is essential for financial marketers looking to position their offerings effectively and resonate with their target audience.

Psychological Factors Influencing Investment Choices

Several psychological factors significantly shape consumer behavior in financial investments. These include risk tolerance, cognitive biases, and emotional influences that can lead individuals to make suboptimal decisions. Recognizing these factors can enhance the effectiveness of marketing strategies.

Risk Tolerance

Investors exhibit varying degrees of comfort with risk, which profoundly influences their investment choices. Those with a higher risk tolerance may gravitate toward stocks and high-yield bonds, whereas risk-averse individuals often prefer safer options like government bonds or fixed deposits.

Cognitive Biases

Investors are often subject to cognitive biases, such as overconfidence or loss aversion, which can affect their decision-making. For instance, an overconfident investor might disregard sound advice and invest heavily in a volatile market, driven by a belief in their own ability to foresee market movements.

Emotional Influences

Emotions like fear and greed can lead to impulsive investment decisions. In times of market volatility, fear may prompt investors to sell off assets prematurely, while greed during a bull market can encourage over-investment in high-risk assets.

Demographic Impact on Consumer Behavior in Financial Markets

Demographic factors, including age, income, and education level, play a crucial role in shaping consumer behavior in the investment arena. Each demographic segment demonstrates distinct preferences and attitudes towards risk and investment strategies.

Age

Younger investors may prioritize growth-oriented investments, such as equities, given their longer time horizon. In contrast, older investors closer to retirement might favor income-generating assets, like bonds, to preserve capital.

Income

Higher income levels can lead to greater investment in diverse financial products, including alternative investments like real estate or private equity. Conversely, lower-income individuals might focus on more accessible and less risky investment options such as mutual funds or savings accounts.

Education

Financial literacy is often correlated with a higher level of education. Educated investors are more likely to engage in complex investment strategies and are better equipped to understand market dynamics. This understanding can lead to more strategic investment decisions, reducing the likelihood of falling prey to market hysteria.Understanding consumer behavior in financial investments is not just an academic exercise; it has practical implications for both investors and financial institutions.

By analyzing psychological factors and demographic influences, marketers can create tailored investment products that meet the specific needs of their target markets, ultimately leading to a more efficient allocation of resources in the financial ecosystem.

The Role of Trust in Investment Marketing

Trust serves as the cornerstone of any financial relationship, particularly in investment marketing. Investors, whether seasoned or new, look for assurance that their hard-earned money is in safe hands. Without trust, potential customers may hesitate or outright refuse to engage with financial products. For financial institutions, establishing trust can translate directly into client loyalty, retention, and overall business success. The significance of trust in marketing financial investment products cannot be overstated.

It influences how investors perceive risk and return, ultimately affecting their investment decisions. When consumers trust a financial institution, they are more likely to invest in its products, whether it’s stocks, bonds, or mutual funds. Trust is not merely a feel-good notion; it is a measurable component of a successful investment strategy.

Strategies to Build Trust with Potential Investors

Financial institutions employ various strategies to foster trust among potential investors. These strategies not only enhance the firm’s reputation but also create a sense of security for clients. Below are key tactics used to build this essential trust:

- Transparency: Providing clear and honest information about investment products, including risks and fees, fosters an environment of openness that is crucial for trust-building.

- Regulatory Compliance: Adhering to industry regulations and standards reassures investors that the institution is committed to ethical practices.

- Customer Education: Offering educational resources such as webinars, articles, and consultations empowers clients to make informed decisions, thereby strengthening their trust in the institution.

- Strong Customer Support: Having responsive and knowledgeable customer service teams can significantly enhance the trust level, as clients feel supported throughout their investment journey.

- Client Testimonials: Showcasing reviews and success stories from existing clients can provide social proof of the institution’s reliability and effectiveness.

The trust levels required for different types of investment products can vary. For instance, investing in stocks typically requires a higher level of trust as these investments are generally subject to greater volatility and risk. Investors must believe in the company’s potential for growth and sustainability to engage in stock markets confidently. Conversely, bonds, often considered safer investment vehicles, may require comparatively less trust.

The perception that bonds are backed by more stable assets or government guarantees can make investors feel more secure. However, even in bond investing, trust remains essential. Investors need faith in the issuing entity’s ability to honor its obligations.

“Trust in financial investments is not just a preference; it is a necessity that shapes investor behavior.”

Ultimately, the role of trust in investment marketing is pivotal, influencing how financial products are perceived and adopted by consumers. By understanding the dynamics of trust and employing effective strategies, financial institutions can better connect with potential investors, paving the way for successful investment experiences.

Influence of Social Proof on Investment Decisions

The concept of social proof plays a pivotal role in shaping consumer behavior, particularly in the realm of financial investments. It refers to the psychological phenomenon where individuals tend to look to others for cues on how to behave in uncertain situations. In the context of financial investments, this means that potential investors often rely on the actions and opinions of their peers, experts, and the general public to make informed decisions.

As a result, social proof can significantly influence not only the perception of investment products but also their ultimate adoption by consumers.Social proof affects consumer choices in financial investments by providing a sense of validation and reassurance. When investors observe that others have made successful investment choices or have positive experiences with specific financial products, they are more likely to trust and choose those products themselves.

This effect can be amplified through various marketing strategies that leverage testimonials and reviews.

Impact of Testimonials and Reviews on Investment Marketing

Testimonials and reviews serve as powerful tools in the marketing of investment products. They provide firsthand accounts of customer experiences, which can greatly influence potential investors. The importance of these elements can be understood through the following points:

- Credibility: When potential investors see genuine testimonials from satisfied customers, it enhances the credibility of the investment product. For instance, a prominent investment firm may feature success stories from clients who achieved significant returns, thus instilling trust in prospective investors.

- Relatability: Personal anecdotes can resonate with potential investors. For example, a testimonial from an everyday investor who started with a modest amount and achieved financial goals can inspire confidence and encourage action.

- Community Endorsement: Reviews showcasing positive outcomes create a sense of community approval. Investors are likely to be influenced by the actions of others, particularly if they perceive those individuals as similar to themselves.

“Seeing others succeed in their investments provides the reassurance that one can achieve similar results, influencing decision-making in a significant way.”

Role of Social Media in Shaping Investment Perceptions

Social media platforms have revolutionized how financial information is shared and consumed. They serve as forums for discussion, feedback, and validation, further enhancing the influence of social proof in investment decisions.Key aspects of social media’s impact include:

- Real-Time Interaction: Investors can share their experiences and opinions instantly, allowing potential investors to access a wealth of information at their fingertips. Online discussions can sway perceptions quickly, with trending topics often guiding investment choices.

- Influencer Perspectives: Financial influencers and thought leaders play a crucial role on platforms like Twitter and Instagram. Their endorsements can lead to substantial shifts in consumer interest and investment trends, as followers are likely to trust their expertise.

- Peer Reviews and Recommendations: Social media allows for direct peer-to-peer interactions where individuals can seek advice, share insights, and recommend investment products based on their experiences, further solidifying the influence of social proof.

“Social media has transformed the investment landscape, where likes, shares, and comments can dictate market sentiment and consumer behavior.”

Behavioral Biases in Investment Choices

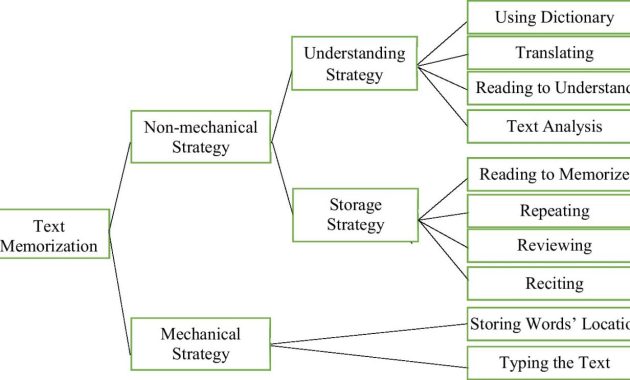

Behavioral biases significantly impact consumer decisions in financial investments, shaping how individuals perceive risks, opportunities, and ultimately their investment strategies. Understanding these biases is crucial for marketers aiming to tailor their financial products and communications to resonate with potential investors. By recognizing the psychological factors at play, marketers can create strategies that align with consumer behavior, fostering engagement and trust.Common behavioral biases can distort even the most rational decision-making processes.

These biases can lead investors to make impulsive choices or avoid necessary risks, ultimately affecting their financial outcomes. Identifying these biases is essential for marketers as it provides insight into how to frame financial products effectively.

Common Behavioral Biases Affecting Investment Behavior

Behavioral biases can significantly influence investment choices, often leading to irrational decisions. Below are some of the most prevalent biases that marketers should consider:

- Overconfidence Bias: Investors often overestimate their knowledge and predictive abilities, leading to excessive trading and risk-taking.

- Loss Aversion: The tendency to prefer avoiding losses rather than acquiring equivalent gains can result in a reluctance to invest in potentially profitable opportunities.

- Herd Behavior: Many investors follow the crowd, buying or selling based on the actions of others rather than their own analysis, which can create market bubbles or crashes.

- Anchoring Bias: Investors may fixate on specific numbers, such as the price at which they bought an asset, which can impede their decision-making when market conditions change.

Understanding these biases is not only essential for recognizing consumer behavior but also revealing implications for marketing strategies. Marketers can develop targeted campaigns that address these biases, guiding consumers toward more rational investment choices.

Implications of Behavioral Biases for Marketing Financial Products

Behavioral biases present both challenges and opportunities for marketers in the financial sector. Recognizing these biases enables marketers to craft messages that resonate more deeply with consumers’ emotions and cognitive patterns. For instance, marketing strategies can be designed to mitigate loss aversion by emphasizing the long-term benefits of investments rather than the potential short-term fluctuations. Educating consumers about the dangers of herd behavior can promote a more balanced approach to investment decisions.

Designing Campaigns to Counteract Behavioral Biases

Marketers can employ several techniques to counteract the effects of behavioral biases and enhance the effectiveness of their campaigns:

- Educational Content: Providing clear, informative resources that explain investment principles can empower consumers to make informed decisions.

- Visualization Tools: Utilizing charts and graphs to show potential growth over time can help combat overconfidence and anchoring biases by illustrating the broader market context.

- Behavioral Nudges: Implementing strategies that encourage positive investment behaviors, such as automatic rebalancing or reminders about long-term goals, can mitigate impulsive decisions.

- Trust-Building Strategies: Establishing credibility through testimonials and transparent communication can help alleviate the anxiety associated with loss aversion and build confidence in investment choices.

By understanding and addressing these behavioral biases, marketers can create more effective strategies that not only promote financial products but also contribute to better investment decisions among consumers.

The Impact of Economic Conditions on Consumer Investment Behavior

Understanding the correlation between economic conditions and consumer behavior is vital for financial marketers aiming to capitalize on changing climates. Economic indicators such as employment rates, inflation, and GDP growth significantly influence consumers’ confidence to invest. As these indicators fluctuate, so too does the willingness of consumers to engage in financial investments. This analysis provides insights into how marketers can tailor their strategies to align with various economic cycles, thereby enhancing the efficacy of their campaigns.Economic conditions play a crucial role in shaping consumer sentiment towards investment products.

When economic indicators signal growth—such as low unemployment rates and rising consumer spending—confidence in investing typically increases. Conversely, during periods of recession or economic uncertainty, consumers may become more risk-averse, preferring to save rather than invest. Financial marketers must navigate these conditions by adapting their messaging and product offerings to meet the evolving demands of consumers.

Influence of Economic Indicators on Consumer Confidence

Economic indicators serve as barometers of consumer confidence, directly impacting investment behaviors. Key indicators include:

- Unemployment Rate: A lower unemployment rate generally boosts consumer confidence, leading to increased investments in financial products. For example, post-recession recovery phases often see a spike in mutual fund investments as job security increases.

- Inflation Rates: Moderate inflation can encourage consumer spending, reflecting a willingness to invest. However, high inflation may deter investments as consumers prioritize saving to maintain purchasing power.

- Interest Rates: Lower interest rates typically make borrowing cheaper, encouraging investments in stocks and bonds. In contrast, higher rates may lead to decreased investment activity as consumers face elevated costs for loans.

Understanding these indicators allows marketers to create targeted campaigns. During periods of economic growth, promotional strategies can highlight growth potential and favorable investment opportunities. Conversely, during downturns, focusing on security and risk management tools can resonate more effectively with consumers.

Marketing Financial Products During Economic Cycles

Adapting marketing strategies to resonate with consumers during different economic cycles is essential for success in the financial investment landscape. Strategies can be differentiated based on the economic environment, as Artikeld below:

- During Expansion: Highlight the potential for high returns on investments and promote aggressive growth funds to capitalize on high consumer confidence.

- During Recession: Emphasize stability, risk management, and the importance of diversified portfolios. Marketing messages should reassure consumers of the safety and reliability of products.

- During Recovery: Position products that focus on emerging opportunities and potential gains as the market rebounds. Target consumers looking to re-enter the investment arena.

Marketers must remain agile in their approach, responding dynamically to changing economic conditions to maintain consumer engagement and trust.

Importance of Understanding Economic Trends for Effective Marketing

A deep understanding of economic trends is imperative for crafting effective marketing strategies in the financial sector. Recognizing shifts in consumer behavior driven by economic changes allows marketers to:

- Adapt messaging to align with current consumer sentiments, thereby increasing the relevance of marketing communications.

- Identify opportunities for product innovation tailored to the needs of consumers facing specific economic challenges.

- Build trust with consumers by demonstrating an awareness of their concerns and providing solutions that meet their financial needs during varying economic cycles.

Incorporating economic data into marketing strategies not only enhances consumer engagement but also fosters long-term relationships built on trust and confidence. Successful financial marketers leverage these insights to create compelling narratives around their investment products, ensuring they remain relevant and appealing in any economic climate.

Segmentation and Targeting in Financial Investment Marketing: How Consumer Behavior Influences The Marketing Of Financial Investment Products

Market segmentation is a critical strategy in the financial investment sector, allowing marketers to tailor their approaches based on the diverse preferences and behaviors of various consumer groups. By understanding the nuances of different segments, financial institutions can effectively meet the needs of their clients, fostering stronger relationships and enhanced customer loyalty. Investment products can vary widely, and recognizing these differences ensures that offerings are not only relevant but also compelling for each segment.Segmentation involves categorizing consumers based on distinct characteristics that influence their investment behavior.

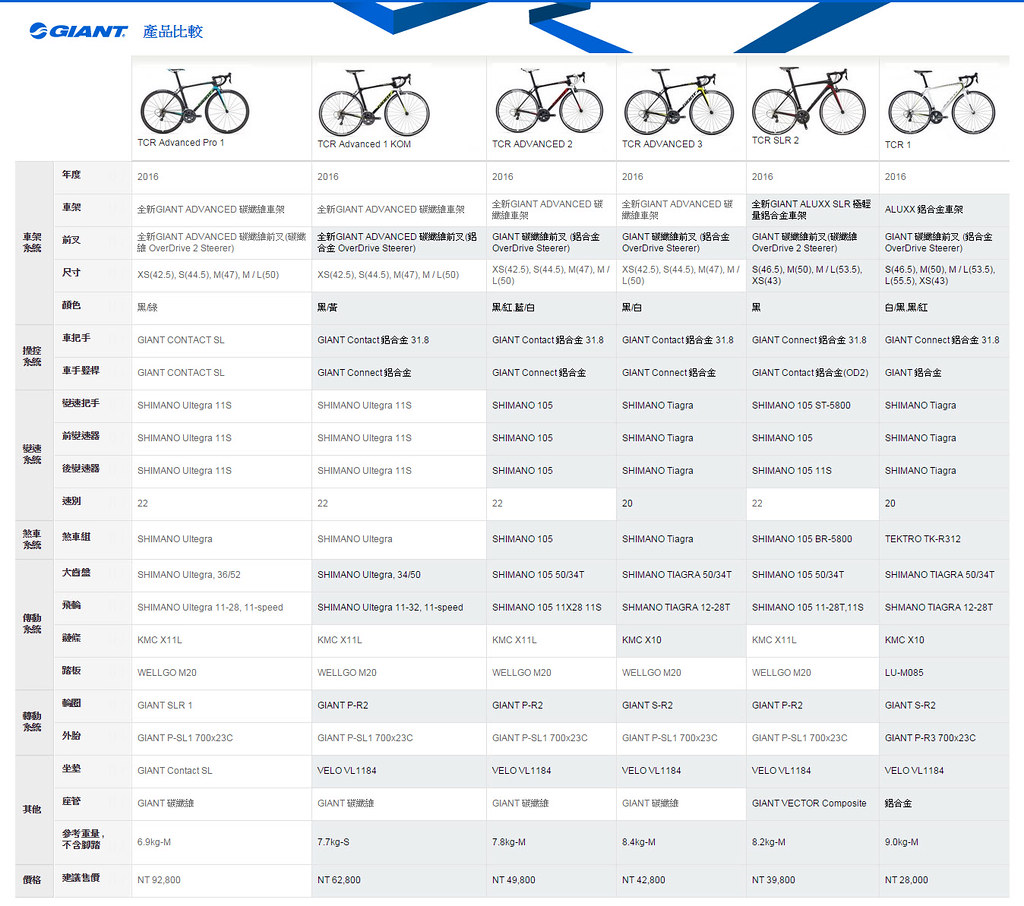

Effective segmentation requires a comprehensive understanding of the market and the unique preferences of potential investors. Key consumer segments often identified in financial investment marketing include millennials, affluent investors, retirees, and socially responsible investors. These groups exhibit varying risk tolerances, investment goals, and preferred channels for receiving information.

Key Consumer Segments and Their Investment Preferences

Understanding the unique characteristics of each consumer segment is essential for crafting targeted marketing strategies. Below are key segments along with their investment preferences:

- Millennials: This group tends to lean towards technology-driven investment platforms and is interested in sustainable and socially responsible investing. They prioritize digital engagement and value transparency in investment communications.

- Affluent Investors: Typically more risk-tolerant, affluent investors look for diverse portfolios that include alternative investments such as real estate and private equity. They prefer personalized services and high-touch experiences from investment advisors.

- Retirees: Focused on income preservation and risk management, retirees prioritize stability and consistent returns. They often seek fixed-income products and are interested in retirement planning services that ensure long-term financial security.

- Socially Responsible Investors: This segment actively seeks investments that align with their values, emphasizing ESG (Environmental, Social, and Governance) criteria. They prefer transparent reporting on the social impact of their investments.

Framework for Targeting Different Consumer Segments Effectively

To engage effectively with each consumer segment, a well-structured targeting framework is essential. This framework should consider the specific needs, communication preferences, and behaviors of each group.

- Data Analytics: Utilize data analytics to gain insights into consumer behaviors and preferences, allowing for the development of targeted marketing strategies.

- Personalized Messaging: Craft personalized marketing messages that resonate with each segment’s values and expectations, ensuring relevance and engagement.

- Multi-Channel Approach: Implement a multi-channel marketing strategy that includes digital advertising, social media engagement, and traditional marketing channels, catering to the varying preferences of each segment.

- Education and Resources: Provide educational resources tailored to each segment, such as webinars for millennials or investment guides for retirees, to empower consumers in their investment decisions.

“Effective segmentation in financial investment marketing not only enhances engagement but also drives higher conversion rates, as consumers feel more understood and valued.”

Digital Marketing Strategies for Financial Products

The digital landscape has transformed the marketing strategies employed in the financial sector. As consumers increasingly turn to online platforms for research and investment, financial institutions must adapt their marketing techniques to effectively engage and educate potential investors. This segment explores the critical digital marketing strategies that can enhance the visibility and appeal of financial investment products.Content marketing plays a pivotal role in educating potential investors about complex financial products.

By providing valuable and informative content, financial institutions can establish credibility and foster trust among their audience. Through articles, videos, and infographics, they can demystify investment options, market trends, and risk factors, ultimately empowering consumers to make informed decisions.

Effective Digital Marketing Techniques

A variety of digital marketing techniques can significantly enhance the reach and impact of financial investment products. Below are key strategies that financial institutions can implement:

- Search Engine Optimization (): Optimizing website content for relevant s ensures higher visibility in search engine results, attracting potential investors actively seeking information.

- Social Media Marketing: Utilizing platforms like LinkedIn, Twitter, and Facebook enables financial firms to engage with a broader audience, share insights, and promote investment products in a conversational manner.

- Email Marketing: Targeted email campaigns can provide personalized content and investment opportunities to subscribers, keeping them informed and engaged.

- Webinars and Online Workshops: Hosting educational sessions allows financial institutions to showcase their expertise, address investor concerns, and promote their products in a conducive environment.

- Pay-Per-Click (PPC) Advertising: Using targeted advertising through platforms like Google Ads helps reach specific demographics, driving traffic to product landing pages and increasing conversions.

The Role of Content Marketing, How Consumer Behavior Influences the Marketing of Financial Investment Products

Content marketing is essential for demystifying financial products and building relationships with prospective investors. Effective content strategies include:

- Blog Posts: Publishing regular articles that cover market trends, investment strategies, and financial advice positions the institution as a trusted resource.

- Video Tutorials: Creating engaging video content can simplify complex concepts, making investment decisions more approachable for novice investors.

- Infographics: Visual representations of data and investment processes can aid understanding and retention among potential clients.

- Case Studies: Sharing success stories of past clients provides real-life evidence of investment product effectiveness, fostering credibility.

Examples of Successful Digital Campaigns

Several financial institutions have successfully leveraged digital marketing to promote their investment products. Notable examples include:

- Vanguard’s “Investing for the Long Term” Campaign: This campaign utilized a series of educational videos and articles that focused on long-term investing strategies, greatly enhancing brand trust and customer engagement.

- Fidelity’s Social Media Engagement: Through proactive engagement on platforms like Twitter, Fidelity has effectively communicated market updates and investment tips, driving traffic to their services.

- Charles Schwab’s Personalized Email Initiatives: By segmenting their email list based on client interests and investment behaviors, Charles Schwab has achieved higher open and conversion rates.

These effective digital marketing strategies not only drive engagement but also empower consumers to navigate the complex world of financial investments confidently.

Ethical Considerations in Marketing Financial Investments

In the realm of financial investment marketing, ethical considerations are crucial to fostering trust and promoting responsible investment practices. Marketers must navigate the complexities of consumer psychology while adhering to ethical standards that protect consumers and enhance the integrity of the financial industry. This responsibility extends beyond mere compliance with laws; it encompasses a commitment to transparency, honesty, and accountability in all marketing efforts.Marketers have ethical responsibilities that include providing accurate information, avoiding deceptive advertising, and prioritizing the best interests of consumers.

Ethical marketing practices not only safeguard consumers but also build long-term relationships, contributing to brand loyalty and a positive corporate reputation.

Guidelines for Transparent Communication in Investment Marketing

Clear and transparent communication is vital in investment marketing to ensure consumers can make informed choices. The following guidelines can help marketers fulfill their ethical obligations:

- Provide Comprehensive Information: All marketing materials should include essential details about the investment products being offered, including risks, fees, and potential returns. This empowers consumers to make informed decisions.

- Avoid Jargon: Using overly technical language can alienate consumers. Marketers should aim to communicate in clear, straightforward terms that are easily understood by the target audience.

- Disclose Conflicts of Interest: Transparency regarding any conflicts of interest is essential. Marketers should openly disclose any affiliations or incentives that could influence their recommendations.

- Use Realistic Performance Data: When showcasing investment performance, it is crucial to present data that is realistic and representative of actual results, avoiding selective data that may mislead consumers.

- Regularly Update Information: Ensure that all materials reflect the most current information available. Outdated data can mislead consumers and erode trust.

“Transparency breeds trust; without it, the foundation of a successful marketing strategy crumbles.”

Misleading marketing practices can have serious consequences, not only for consumers but also for the financial institution itself. The implications of such practices can include legal ramifications, financial penalties, and damage to the brand’s reputation. Ethical lapses can lead to consumer distrust, potentially resulting in diminished sales and long-term business viability. The integrity of the financial market relies heavily on the commitment of marketers to uphold ethical standards, fostering an environment where consumers feel secure in their investment decisions and trust the products being marketed to them.