How Digital Tools Are Transforming Insurance Product Marketing and Sales is revolutionizing the way insurance companies engage with customers. In this digital age, embracing innovative technologies is no longer optional but essential for success in the competitive insurance landscape. From social media marketing to data analytics, these digital tools are enhancing customer interactions and reshaping the marketing strategies of insurers.

As consumer behavior shifts towards digital platforms, insurance providers must adapt to meet their customers where they are. The integration of advanced digital marketing tools not only streamlines the process but also offers insights into consumer preferences, ensuring that marketing efforts are targeted and effective. In this exploration, we will uncover the pivotal role that digital transformation plays in modernizing insurance marketing and sales.

Overview of Digital Tools in Insurance Marketing

In today’s fast-paced digital era, the insurance industry is witnessing a transformative shift in marketing strategies. Digital tools have become indispensable for insurance companies aiming to reach and engage consumers effectively. The integration of technology not only streamlines processes but also enhances the customer experience, making it essential for insurers to adapt to these changes.The evolution of technology has significantly influenced consumer behavior within the insurance sector.

Consumers are increasingly relying on digital channels to research and purchase insurance products, seeking convenience, transparency, and personalization. This shift has led companies to harness digital marketing tools to capture the attention of prospective clients and retain existing ones, ensuring a competitive edge in a crowded marketplace.

Key Digital Marketing Tools in Insurance Sales, How Digital Tools Are Transforming Insurance Product Marketing and Sales

The strategic deployment of digital marketing tools is vital for effective sales and customer engagement in the insurance sector. These tools facilitate targeted marketing efforts, enhance customer interactions, and ultimately drive sales growth. The following are key digital marketing tools commonly used in insurance sales:

- Social Media Platforms: Social media has emerged as a powerful tool for engaging with customers. Platforms like Facebook, LinkedIn, and Instagram allow insurance companies to share valuable content, build brand awareness, and connect with potential clients on a personal level.

- Email Marketing: Targeted email campaigns help insurers communicate directly with customers, providing personalized offers and updates. This tool is essential for nurturing leads and maintaining relationships with existing clients.

- Customer Relationship Management (CRM) Systems: CRMs enable insurance companies to manage interactions with clients efficiently. They help track customer data, preferences, and behaviors, allowing for tailored marketing strategies and improved customer service.

- Search Engine Optimization (): Optimizing websites for search engines is crucial for increasing online visibility. By employing techniques, insurance companies can drive organic traffic to their sites, enhancing lead generation efforts.

- Content Marketing: Creating informative and engaging content positions insurance providers as thought leaders in the industry. Blogs, articles, and videos that address customer pain points can attract and retain clients while improving brand credibility.

- Chatbots and AI Technology: These tools offer real-time customer support and streamline inquiries, ensuring instant responses to customer questions. This enhances user experience and drives higher engagement rates.

The adoption of these digital tools not only facilitates smoother operations but also meets the evolving expectations of tech-savvy consumers. Companies that leverage these solutions can optimize their marketing efforts, ultimately leading to increased sales and stronger customer loyalty.

Social Media Strategies for Insurance Products

In today’s digital landscape, social media has emerged as a powerful tool for insurance companies to reach potential customers, build brand awareness, and drive sales. By leveraging various platforms, insurers can create tailored strategies that resonate with their target audiences and promote their products effectively. The following sections will delve into the best social media platforms for insurance marketing, effective engagement practices, and successful campaign examples.

Effective Social Media Platforms for Promoting Insurance Products

Choosing the right social media platforms is crucial for maximizing outreach and engagement. Each platform has unique characteristics that can be utilized to target specific demographics. The most effective platforms for promoting insurance products include:

- Facebook: With a diverse user base, Facebook allows insurers to share informative content, create targeted ads, and foster community engagement through groups and pages.

- LinkedIn: Ideal for B2B marketing, LinkedIn enables insurance companies to connect with businesses and professionals, share industry insights, and establish thought leadership.

- Instagram: This visually-driven platform is perfect for showcasing lifestyle content, customer testimonials, and infographics, making complex insurance concepts more relatable.

- Twitter: Twitter facilitates real-time communication and updates, making it an effective platform for customer service and sharing timely news in the insurance sector.

Best Practices for Engaging Potential Customers Through Social Media

Engaging potential customers on social media requires strategic planning and execution. Here are some best practices that insurance marketers should consider:

- Consistent Brand Messaging: Maintain a uniform voice and message across all platforms to build brand identity and trust.

- Content Variety: Use a mix of videos, infographics, and articles to cater to different preferences and keep the audience engaged.

- Interactive Content: Polls, quizzes, and live Q&A sessions can foster interaction and provide insights into customer preferences.

- Customer Testimonials: Sharing authentic customer stories can enhance credibility and showcase the value of your insurance products.

- Responsive Communication: Promptly addressing inquiries and feedback helps to build a relationship with potential customers and demonstrates excellent customer service.

Examples of Successful Insurance Campaigns on Social Media

Several insurance companies have executed successful social media campaigns that effectively engaged their target audiences and promoted their products. Notable examples include:

- Geico’s “Hump Day” Campaign: This humorous ad campaign utilized social media to go viral, significantly increasing brand awareness and customer engagement.

- Progressive’s “Flo” Campaign: Leveraging a recognizable character, Progressive built a strong social media presence, using relatable humor to connect with customers.

- State Farm’s “Meet the Neighbors” Initiative: By highlighting real customer stories, State Farm effectively showcased the benefits of their policies, fostering a sense of community and trust.

“Social media is not just about posting content; it’s about building relationships and creating value for your audience.”

Marketing Expert

The Role of Data Analytics in Insurance Marketing

In the modern insurance landscape, data analytics serves as a cornerstone for shaping effective marketing strategies. Insurance companies increasingly rely on data-driven insights to understand consumer behaviors, preferences, and trends. By integrating advanced analytics into their marketing efforts, insurers can create tailored campaigns that resonate with their target audiences, leading to improved customer engagement and higher conversion rates.Data analytics significantly influences marketing strategies within the insurance sector by enabling companies to harness vast amounts of customer data.

Methods for collecting this data include leveraging digital platforms, customer interactions, and social media engagement. By analyzing this information, insurers can identify patterns and insights that inform their strategies. A robust data analytics framework allows for segmentation of the customer base, ensuring that marketing messages are not only relevant but also personalized.

Methods for Collecting and Analyzing Customer Data

A variety of methods exist for collecting and analyzing customer data to enhance targeted marketing strategies. These methods empower insurance companies to gain deep insights into their clientele:

- Customer Surveys: Direct feedback through surveys allows insurers to gather qualitative and quantitative data about customer preferences and needs.

- Website Analytics: Analyzing traffic patterns and user behavior on company websites helps identify which products attract the most interest and how users navigate the site.

- Social Media Monitoring: Tracking engagement levels and sentiment on social platforms provides insights into how potential customers perceive brand offerings.

- CRM Systems: Customer Relationship Management tools compile data from various touchpoints, allowing for a comprehensive view of customer interactions and histories.

- Predictive Analytics: Using historical data to make predictions about future behaviors enables insurers to tailor products and marketing efforts proactively.

Combining these methods allows insurers to create a holistic view of their customers and fine-tune their marketing strategies accordingly.

Successful Examples of Insurance Companies Leveraging Data Analytics

Several insurance companies have successfully utilized data analytics to transform their marketing efforts and improve business outcomes. These examples illustrate the profound impact of data-driven decision-making in the sector:

- Progressive Insurance: By employing predictive analytics, Progressive has optimized its pricing strategies and personalized marketing campaigns based on customer data, resulting in enhanced customer acquisition and retention.

- Allstate: Allstate’s use of telematics data through its Drivewise program allows the company to analyze driving behaviors and offer personalized insurance premiums, attracting tech-savvy customers seeking tailored solutions.

- State Farm: Through extensive data analysis, State Farm has been able to identify risks and trends in its customer base, leading to the development of targeted marketing campaigns that significantly boost policy sales.

- Geico: Geico leverages data analytics to create dynamic digital advertising strategies, maximizing their reach and engagement with potential customers across various platforms.

These companies demonstrate that integrating data analytics within marketing strategies not only enhances customer understanding but also drives business growth and innovation in the insurance industry.

Customer Relationship Management (CRM) Tools

In the rapidly evolving landscape of insurance marketing, Customer Relationship Management (CRM) tools have become indispensable for agents looking to streamline their operations and foster deeper connections with their clients. These powerful systems are designed to manage customer interactions, track sales leads, and analyze customer data, significantly enhancing the insurance sales process. Effective CRM tools offer a range of features that cater specifically to the needs of insurance agents.

These functionalities not only help in organizing client information but also aid in developing targeted marketing strategies that drive customer engagement and retention.

Features of Effective CRM Tools for Insurance Agents

An efficient CRM system for insurance agents should include essential features tailored to the unique demands of the insurance industry. Understanding these features can facilitate the selection of a CRM that fits business requirements. Key features include:

- Lead Management: A robust lead management system captures and tracks potential clients, ensuring no opportunity slips through the cracks.

- Policy Management: This feature allows agents to manage and monitor client policies, including renewals and claims, directly within the CRM.

- Automated Communication: Automated reminders and follow-ups can enhance customer engagement, ensuring timely communication with clients.

- Analytics and Reporting: Detailed analytics on client behaviors and sales performance help agents make data-driven decisions.

- Integration Capabilities: Integration with other tools and platforms, such as email marketing software and social media, increases operational efficiency.

Enhancing Customer Engagement and Retention through CRM Systems

CRM systems play a crucial role in strengthening customer engagement and retention for insurance firms. By providing a centralized platform for managing client information and interactions, these tools enable agents to personalize their communication and services significantly. A well-implemented CRM strategy can enhance engagement through:

- Personalized Marketing: Customized marketing messages based on customer data and preferences lead to more relevant interactions.

- Improved Customer Service: Quick access to client history and needs allows agents to resolve queries promptly, enhancing customer satisfaction.

- Proactive Communication: Regular updates about policy changes or new offerings keep clients informed and engaged.

- Feedback Mechanisms: Implementing surveys and feedback options allows clients to voice their opinions, making them feel valued and heard.

Comparison of Popular CRM Tools Used in the Insurance Industry

With several CRM tools available in the market, it is essential to compare their features and capabilities to find the best fit for insurance agents. Below is a comparative overview of some popular CRM solutions tailored for the insurance sector.

| CRM Tool | Key Features | Best For |

|---|---|---|

| Salesforce | Customizable dashboards, extensive integrations, lead scoring | Large agencies with diverse needs |

| HubSpot | Inbound marketing tools, email tracking, pipeline management | Small to medium-sized agencies |

| Zoho CRM | Multi-channel communication, workflow automation, analytics | Budget-conscious agencies |

| InsuredMine | Policy tracking, automation, client portal | Insurance-specific functionalities |

Leveraging a CRM system tailored to the insurance industry not only simplifies operations but also fosters a more personalized relationship with clients, ultimately driving growth and profitability in a competitive market.

Personalization and Customer Experience

In the competitive landscape of insurance, personalization and customer experience have emerged as critical components for success. Insurers are increasingly leveraging digital tools to tailor their marketing communications and enhance customer interactions. By focusing on individual needs and preferences, insurance companies can foster deeper connections with clients, leading to higher satisfaction and loyalty. This segment explores effective techniques for personalization, the importance of customer experience in sales, and ways to gather valuable customer feedback.

Techniques for Personalizing Insurance Marketing Communications

Personalizing marketing communications is essential for engaging customers and driving sales. Here are effective techniques insurers can implement:

- Segmenting Customer Data: Utilize data analytics to segment customers based on demographics, behavior, and preferences. This allows for targeted messaging that resonates with specific groups.

- Dynamic Content Creation: Use dynamic content in emails and online communications that changes based on the recipient’s profile, ensuring relevancy and engagement.

- Customized Product Recommendations: Analyze customer data to recommend insurance products tailored to individual needs, such as home, auto, or life insurance options based on their life stage or purchasing history.

- Personalized Communication Channels: Offer customers their preferred communication channel, whether it be email, SMS, or social media, to enhance the overall experience.

Significance of Customer Experience in Insurance Sales Processes

Customer experience plays a pivotal role in the insurance sales process, influencing customer acquisition and retention. A seamless and positive experience not only attracts new clients but also builds trust and loyalty among existing ones. Insurers must focus on:

- Streamlining the Application Process: Simplifying application procedures with user-friendly interfaces and clear instructions can significantly reduce friction in the sales process.

- Providing Comprehensive Customer Support: Offering multiple support channels, including chatbots and live assistance, ensures that customers receive timely help, enhancing their overall experience.

- Creating Educational Content: Providing informative resources about insurance products and industry trends empowers customers to make informed decisions, thereby boosting satisfaction.

Methods for Obtaining Customer Feedback

Gathering customer feedback is crucial for improving service delivery and enhancing the overall customer experience. Effective methods include:

- Surveys and Questionnaires: Implementing short surveys after key interactions can provide insights into customer satisfaction and areas for improvement.

- Feedback Forms: Offering easy-to-access feedback forms on websites or mobile apps encourages customers to share their thoughts and experiences.

- Social Media Monitoring: Actively monitoring social media platforms for mentions and comments allows insurers to gauge public sentiment and respond promptly to customer concerns.

- Net Promoter Score (NPS): Measuring NPS provides a clear picture of customer loyalty and satisfaction, helping insurers to identify strengths and weaknesses in their service delivery.

Mobile Applications in Insurance Sales: How Digital Tools Are Transforming Insurance Product Marketing And Sales

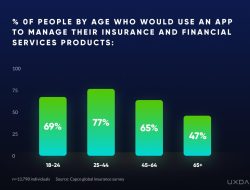

Mobile applications are revolutionizing the way customers interact with insurance providers, offering unparalleled convenience and access to a wide range of insurance products. These tools empower consumers to manage their policies, file claims, and access essential information directly from their smartphones, bringing insurance services right to their fingertips. The integration of mobile technology in insurance sales not only enhances user experiences but also drives engagement and customer satisfaction.As mobile applications become a fundamental part of the insurance landscape, they improve customer interaction with insurance providers by facilitating real-time communication and streamlined processes.

Customers can effortlessly access their policy details, receive updates, and engage with customer support, all from one central location. This level of accessibility fosters a sense of transparency and trust, key factors in building long-lasting customer relationships.

Innovative Features in Leading Insurance Mobile Apps

Innovative features in insurance mobile applications are designed to enhance user experience and make managing insurance more intuitive. The following elements exemplify how leading mobile apps are transforming the insurance sales process:

- Instant Quote Generation: Many apps now allow users to receive instant quotes by entering a few details, eliminating the need for time-consuming calls or paperwork. This feature streamlines the buying process and empowers customers to make informed decisions quickly.

- Claims Submission and Tracking: Innovative apps enable users to submit claims directly through their smartphones, often including the ability to upload photos and documents. Users can also track the status of their claims in real-time, providing peace of mind and reducing anxiety during the claims process.

- Policy Management: Customers can manage their policies, pay premiums, and update personal information all within the app, ensuring they have control over their insurance needs at their fingertips. This convenience encourages users to engage more frequently with their policies.

- Virtual Assistants: Some apps incorporate AI-driven chatbots that can answer questions, provide assistance, and guide users through various processes. This feature enhances customer interaction by providing 24/7 support, helping users feel connected and informed at any time.

- Personalized Recommendations: Utilizing data analytics, mobile applications can provide personalized insurance product recommendations based on user profiles and behaviors. This tailored approach not only enhances customer experience but also increases conversion rates.

“Mobile applications in insurance sales are not just tools; they are gateways to a more connected and responsive insurance experience.”

Automation in Insurance Marketing

Marketing automation tools have become essential in modern insurance marketing, contributing significantly to the streamlining of sales processes. These tools allow insurance companies to automate repetitive tasks, manage campaigns more efficiently, and allocate resources effectively, all of which lead to enhanced productivity and sales outcomes. By integrating automation into their marketing strategies, insurers can focus more on delivering value to their customers while improving operational efficiency.Automation plays a pivotal role in enhancing lead generation and follow-ups in the insurance sector.

By utilizing marketing automation tools, insurance companies can create targeted campaigns that automatically engage potential customers based on their behavior and interactions. This targeted approach not only increases the likelihood of conversion but also ensures that leads are nurtured and followed up with timely communications. The result is a more organized sales process that maximizes the chances of closing deals.

Impact of Marketing Automation on Sales Processes

Implementing marketing automation can revolutionize how insurance companies approach sales. Here are several key benefits:

- Streamlined Workflows: Automation reduces the need for manual intervention in routine tasks such as email marketing, client engagement, and data entry, resulting in faster processing times and fewer errors.

- Enhanced Lead Scoring: Automation tools analyze customer interactions to score leads based on their readiness to purchase, allowing sales teams to prioritize their efforts on high-potential prospects.

- Consistent Follow-Ups: Automated tracking and reminders ensure that leads receive timely follow-ups, maintaining engagement and increasing the chances of conversion.

- Data-Driven Insights: Marketing automation platforms provide analytics that help insurers understand campaign performance, allowing for continuous improvement in strategies.

Success Stories of Automated Insurance Marketing

Several insurance companies have successfully implemented automation, showcasing its effectiveness in transforming marketing efforts.

- Progressive Insurance: By implementing an automated lead nurturing system, Progressive improved its conversion rates significantly. The company used targeted email campaigns based on customer behavior, leading to a 20% increase in quote requests.

- Liberty Mutual: Liberty Mutual utilized marketing automation to streamline its customer engagement process, allowing for personalized messaging at scale. This resulted in a 30% increase in customer retention rates compared to prior strategies.

- Geico: Geico adopted automation tools for their social media campaigns, enabling them to manage responses and interactions with potential customers efficiently. This approach improved their engagement rates dramatically, showcasing how automation can enhance brand visibility.

The strategic implementation of automation tools within insurance marketing not only elevates the efficiency of sales processes but also fosters meaningful connections with customers, ultimately driving business growth and profitability.

Emerging Trends in Digital Insurance Marketing

The digital landscape is rapidly evolving, and the insurance industry is no exception. As consumer expectations change and technology continues to advance, insurance companies are faced with the challenge of adapting their marketing strategies to remain competitive. This segment explores the recent trends influencing the future of digital marketing in insurance and highlights the new technologies reshaping the sales landscape.One significant trend is the increasing use of artificial intelligence (AI) and machine learning in personalized marketing strategies.

These technologies allow insurers to analyze vast amounts of customer data to tailor marketing messages and offers that resonate with individual needs. Additionally, the rise of customer-centric approaches is pushing insurers to focus more on the customer journey, utilizing tools that enhance engagement and satisfaction.

Artificial Intelligence in Customer Insights

Artificial intelligence has emerged as a game-changer in the realm of insurance marketing. By leveraging AI, companies can gain deeper insights into customer behavior and preferences. This data-driven approach enables insurers to create highly targeted marketing campaigns that improve conversion rates. For instance, chatbots powered by AI provide instant support, answering customer inquiries and guiding them through the policy selection process.

This not only enhances customer experience but also streamlines operations for insurers.

Influence of Blockchain Technology

Blockchain technology is increasingly being recognized for its potential to transform various aspects of insurance marketing. It offers a secure and transparent way to store and share data, fostering trust between insurers and customers. The use of smart contracts on blockchain can automate claims processing and policy issuance, reducing the time required for these operations. This transparency not only improves customer confidence but also enhances brand reputation.

Integration of Augmented Reality (AR)

Augmented Reality is poised to revolutionize how insurance products are marketed. By allowing potential customers to visualize insurance coverage in a more interactive manner, AR can significantly enhance engagement. For example, insurers can create AR experiences that let users see potential risks and coverage options in their environment, making the insurance purchasing process more relatable and informative. This innovative approach can help demystify insurance products, leading to better-informed customers.

Omni-channel Marketing Strategies

Adopting an omni-channel marketing approach is crucial for insurers looking to enhance their outreach. This strategy ensures that customers receive a consistent brand experience across multiple platforms, from social media to email and beyond. To implement an effective omni-channel strategy, companies must:

- Understand customer preferences to determine the most effective channels for engagement.

- Utilize data analytics to track customer interactions across different platforms.

- Ensure seamless integration between online and offline marketing efforts.

By prioritizing an omni-channel approach, insurers can create a holistic marketing strategy that meets customers where they are.

Emphasis on Sustainable Practices

Sustainability is becoming a defining trend in insurance marketing. Consumers are increasingly looking for companies that demonstrate a commitment to environmental responsibility. Insurers can adapt to this trend by:

- Promoting eco-friendly policies and coverage options.

- Engaging in community initiatives that support sustainability.

- Leveraging digital marketing to communicate their sustainability efforts effectively.

By aligning their marketing with sustainability principles, insurance companies can resonate with environmentally-conscious consumers, ultimately driving loyalty and trust.

“Embracing emerging technologies not only enhances operational efficiency but also significantly improves customer engagement.”

By staying attuned to these trends and adapting their strategies accordingly, insurance companies can position themselves for success in an increasingly digital marketplace.