How Financial Analysis Drives Smarter Business Purchasing and Investment Decisions is the key to unlocking your company’s potential in a competitive market. By harnessing the power of financial insights, businesses can navigate the complexities of purchasing and investment, making informed decisions that propel growth and enhance profitability. Understanding the pivotal role of financial metrics not only shapes purchasing strategies but also identifies critical indicators that steer successful investment choices.

Through data-driven decision-making, companies are transforming their approach to financial management by leveraging analytics and technology. This insightful journey reveals how strategic budgeting, forecasting, and risk management can lead to more effective purchasing decisions and superior investment outcomes. Discover the tools and methods that define modern financial practices, ensuring your business stays ahead of the curve.

Understanding the Role of Financial Insights

In today’s fast-paced business environment, financial insights are crucial for making informed purchasing and investment decisions. These insights provide a comprehensive understanding of a company’s financial health, allowing decision-makers to navigate their strategies effectively. By leveraging financial metrics, businesses can optimize their procurement processes and enhance their investment portfolios, ultimately driving growth and sustainability.The significance of financial insights cannot be overstated; they serve as the backbone of strategic decision-making.

By analyzing financial data, businesses can identify trends, forecast future performance, and understand the implications of their decisions. This deep-rooted understanding allows organizations to align their purchasing strategies with their overall financial goals, ensuring that every investment made contributes to long-term success.

Influence of Financial Metrics on Purchasing Strategies

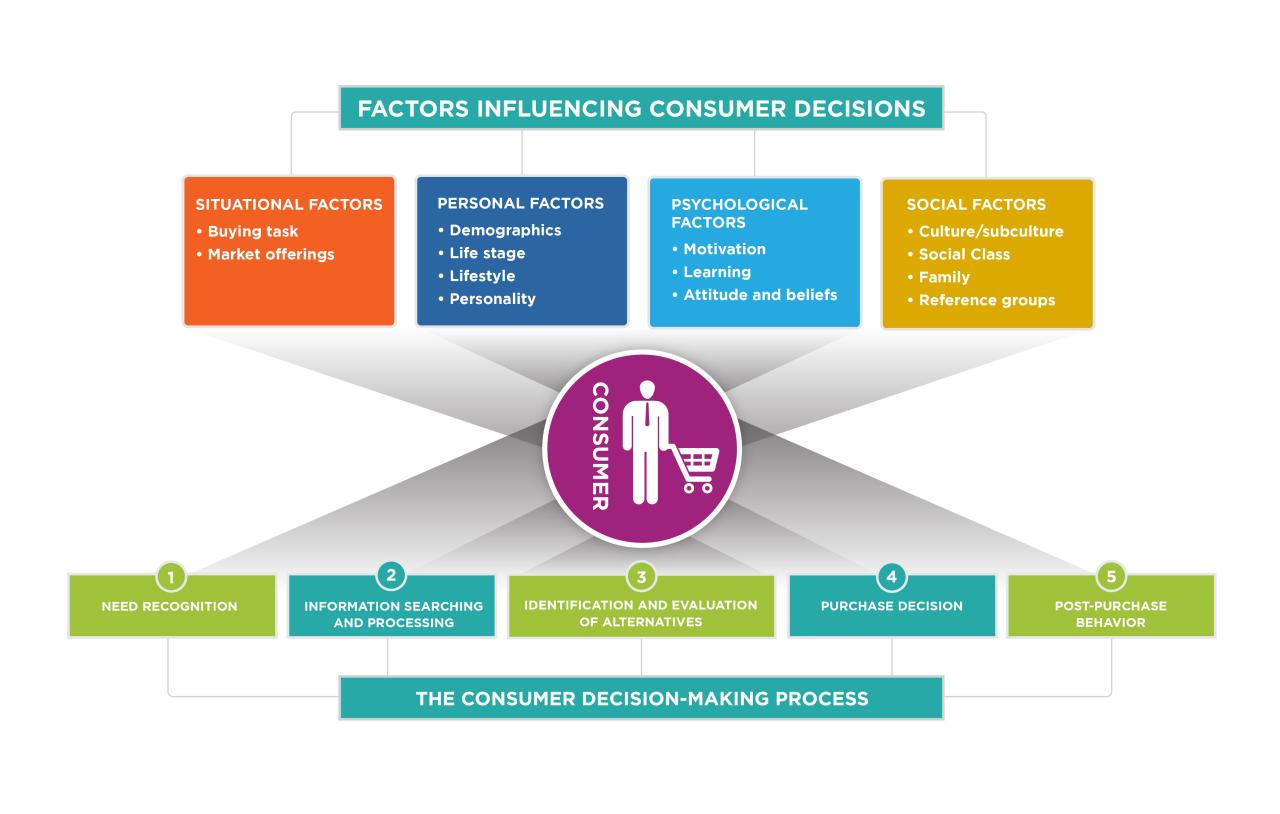

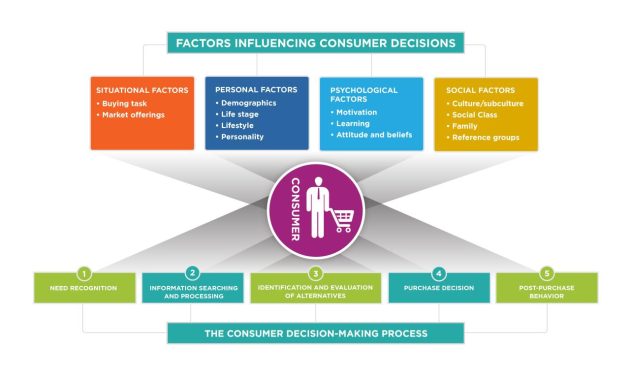

Financial metrics play a pivotal role in shaping purchasing strategies. These metrics help businesses evaluate their spending patterns, assess supplier performance, and identify cost-saving opportunities. Here are some key metrics that influence purchasing decisions:

- Cost of Goods Sold (COGS): Understanding COGS allows a company to determine the efficiency of its production process and pricing strategies.

- Return on Investment (ROI): This metric measures the profitability of investments and helps prioritize purchasing decisions based on potential returns.

- Cash Flow Analysis: Analyzing cash flow ensures that businesses maintain enough liquidity to meet their obligations while investing in growth opportunities.

- Gross Margin: This indicator helps assess the profitability of products and can influence negotiations with suppliers.

The careful analysis of these metrics enables companies to make strategic purchasing decisions that align with their financial objectives.

Key Financial Indicators Impacting Investment Decisions

Investment decisions are critical for business growth and sustainability. Understanding key financial indicators is essential for evaluating potential investment opportunities. Consider the following financial indicators that significantly impact investment decisions:

- Earnings Before Interest and Taxes (EBIT): A higher EBIT indicates a company’s ability to generate profit, making it a favorable investment choice.

- Debt-to-Equity Ratio: This ratio measures financial leverage and risk, helping investors assess the stability of a company before committing funds.

- Price-to-Earnings (P/E) Ratio: A low P/E ratio may indicate undervaluation, presenting a potential investment opportunity.

- Free Cash Flow (FCF): Positive FCF indicates that a company has sufficient cash to invest in growth, pay dividends, and reduce debt.

By closely monitoring these financial indicators, investors can make informed decisions that enhance their investment portfolios, ensuring that they select opportunities that align with their risk tolerance and return expectations.

Financial insights not only drive smarter purchasing decisions but also lay the groundwork for strategic investment opportunities that propel businesses towards success.

The Impact of Data-Driven Decision Making

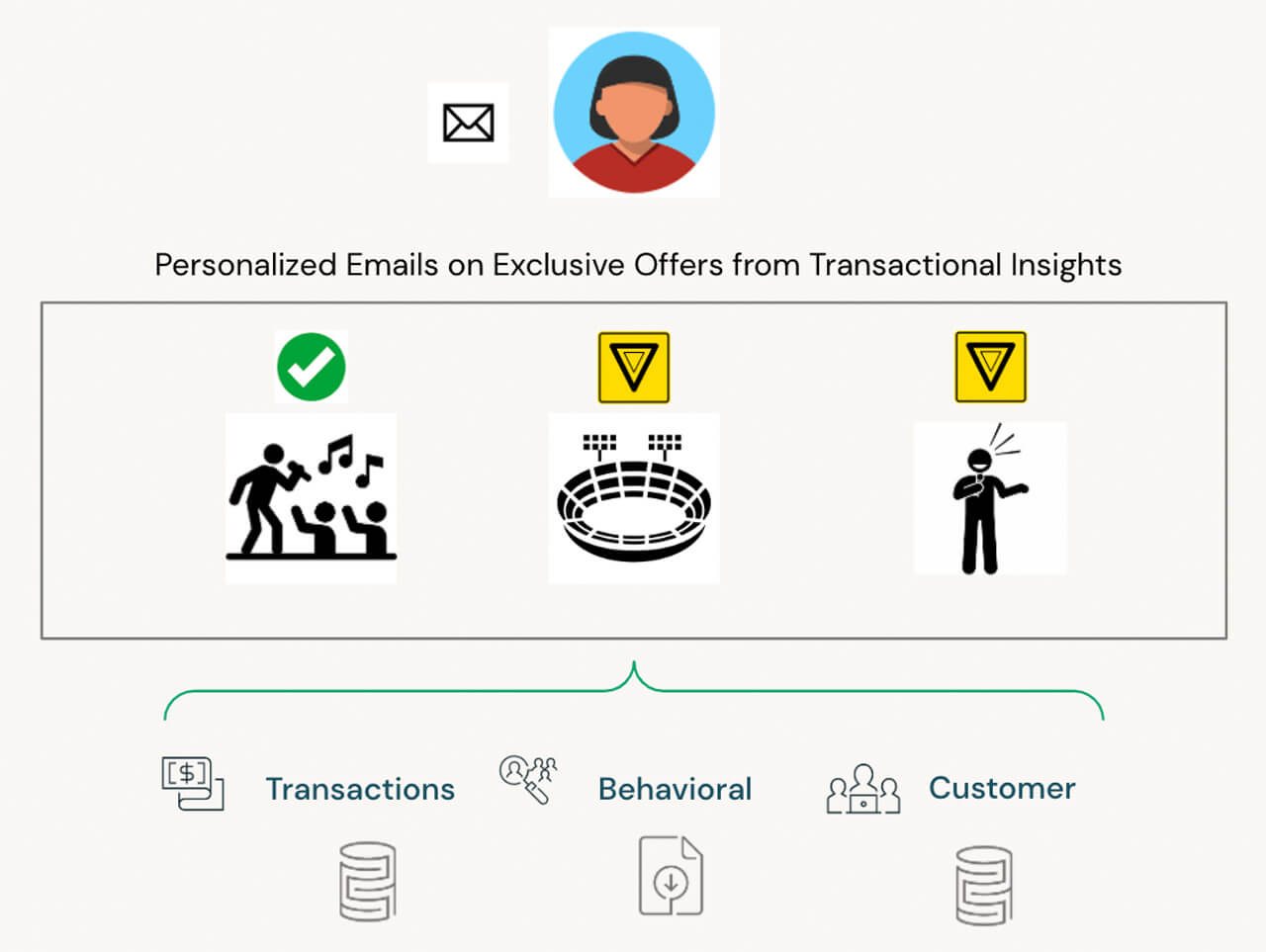

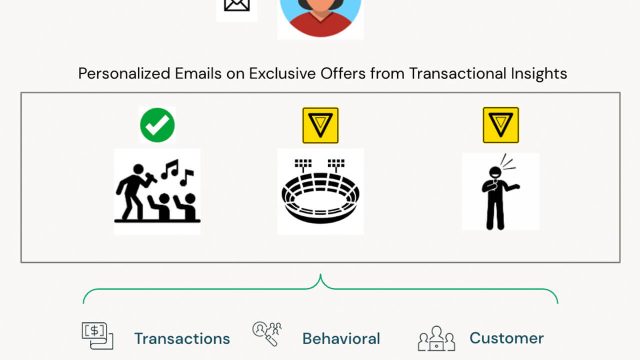

In today’s fast-paced business environment, decisions backed by data can lead to significant competitive advantages. Companies that harness the power of data analytics not only improve their purchasing strategies but also make insightful investment decisions that drive growth and profitability. Embracing data-driven decision-making translates to enhanced efficiency, reduced costs, and informed risk management.Data analytics plays a vital role in shaping purchasing decisions by providing actionable insights that inform strategic choices.

Businesses can analyze market trends, consumer preferences, and financial forecasts to optimize their investments. Leveraging data allows organizations to identify potential opportunities and mitigate risks effectively. As a result, companies that prioritize data-driven approaches can adapt swiftly to market changes and make more informed decisions.

Advantages of Utilizing Data Analytics in Business Purchases

The integration of data analytics into purchasing decisions offers numerous advantages for companies aiming to enhance their operational efficiency and profitability. The following points highlight the importance of data analytics:

- Enhanced Accuracy: Data analytics minimizes human error by providing precise insights into spending patterns and market dynamics.

- Informed Vendor Selection: Companies can evaluate vendors based on comprehensive data, ensuring reliable partnerships.

- Cost Reduction: Analytics helps identify cost-saving opportunities through better negotiation strategies and supplier performance assessments.

- Real-Time Insights: Businesses can leverage real-time data to adapt their purchasing strategies according to market fluctuations.

- Improved Inventory Management: Data-driven insights enable companies to maintain optimal inventory levels, reducing excess stock and associated costs.

Success stories abound in the realm of data-driven investment strategies, showcasing how leading companies harness analytics to fuel growth. For instance, Amazon utilizes advanced data analytics to predict customer purchasing behavior, allowing it to stock inventory effectively and optimize its supply chain. Another example is Netflix, which leverages viewer data to make informed decisions about content creation and acquisition, significantly enhancing viewer engagement and subscription growth.

Role of Technology in Enhancing Financial Decision-Making

The role of technology in financial decision-making cannot be overstated. Advanced tools and platforms empower businesses to analyze vast amounts of data efficiently. Technology facilitates better visualizations, predictive modeling, and scenario analysis, enabling executives to make informed financial choices.Data visualization tools, for instance, transform complex datasets into easy-to-understand formats, allowing decision-makers to glean insights quickly. Predictive analytics technologies, such as machine learning algorithms, help forecast trends and identify potential market shifts, offering a competitive edge to companies that adopt these tools.

“Data-driven decision-making is not just a trend; it’s a fundamental shift that empowers businesses to operate with precision and agility.”

In the finance sector, firms like Goldman Sachs and JPMorgan Chase deploy sophisticated data analytics platforms to streamline their investment strategies, reduce risks, and enhance client services. These institutions exemplify the strategic use of technology in financial decision-making, differentiating themselves in a highly competitive landscape. By integrating technology and data analytics into their operations, businesses can navigate the complexities of the market with greater confidence and success.

Evaluating Investment Opportunities: How Financial Analysis Drives Smarter Business Purchasing And Investment Decisions

In the world of finance, the ability to assess investment opportunities is paramount for businesses aiming to optimize their capital deployment. Evaluating investment opportunities involves a systematic approach that helps organizations make informed decisions while balancing risk and reward. This process not only enhances financial outcomes but also aligns with strategic business goals.Investment assessment can take various forms, including quantitative and qualitative analysis.

Understanding these methods is crucial for businesses that want to maximize returns and minimize potential losses. Different frameworks exist to evaluate investments, which can guide decision-makers in selecting the most promising opportunities.

Methods for Assessing Investment Opportunities

Employing effective methodologies is essential for assessing potential investment opportunities. Various approaches can be utilized to analyze these opportunities, including:

- Net Present Value (NPV): This financial metric calculates the difference between the present value of cash inflows and outflows over a period of time. A positive NPV indicates a profitable investment.

- Internal Rate of Return (IRR): This is the discount rate at which the NPV of an investment becomes zero. A higher IRR signifies a more attractive investment opportunity.

- Payback Period: This method estimates the time required to recover the initial investment. Shorter payback periods are generally preferred as they reduce exposure to risk.

- Return on Investment (ROI): ROI measures the efficiency of an investment by comparing the gain or loss against the initial cost. A higher ROI is indicative of a more favorable investment.

Criteria for Evaluating Risk Versus Reward

Assessing the risk versus reward is a critical step in the investment evaluation process. Several criteria must be considered to make sound investment choices:

- Market Volatility: Analyze the potential fluctuations in market prices to understand the risk involved. Greater volatility may lead to higher potential rewards but also increases risk.

- Economic Conditions: Consider the broader economic environment, as factors like inflation, interest rates, and GDP growth can impact investment performance.

- Industry Trends: Evaluate current trends within the industry to gauge future growth potential and associated risks. Emerging technologies can create opportunities but may also disrupt existing markets.

- Financial Health: Review the financial statements of potential investments. A company with strong fundamentals typically indicates lower risk.

Framework for Prioritizing Investment Projects

A structured framework for prioritizing investment projects is essential for businesses to ensure that resources are allocated efficiently. Such a framework may include the following steps:

- Define Strategic Objectives: Align investments with the company’s long-term goals to ensure they contribute to overall strategy.

- Conduct Financial Analysis: Use metrics like NPV, IRR, and ROI to evaluate the financial viability of each investment opportunity.

- Assess Risk Profiles: Categorize potential investments based on their risk-return profiles to identify acceptable levels of risk.

- Rank Investment Opportunities: Create a scoring system to rank investments based on factors such as expected returns, alignment with strategic goals, and risk assessments.

“A well-thought-out investment strategy balances risk and reward, paving the way for sustainable business growth.”

Budgeting and Forecasting Techniques

Effective budgeting and forecasting are vital components of strategic financial management. They provide businesses with a structured approach to allocate resources efficiently, minimize waste, and maximize investment returns. With the right techniques, organizations can anticipate future needs, adapt to changing market conditions, and make informed purchasing decisions that align with their financial goals.

Effective Budgeting Practices in Purchasing

Structured budgeting practices are essential for optimizing purchasing decisions. A well-defined budget allows companies to control costs and allocate funds toward the most impactful initiatives. Here are key practices to consider:

- Zero-Based Budgeting: This approach requires each department to justify its budget from scratch, ensuring all expenses are necessary and aligned with organizational objectives.

- Performance-Based Budgeting: Linking budget allocations to specific performance outcomes helps prioritize spending on initiatives that drive measurable results.

- Rolling Budgets: Updating budgets at regular intervals allows businesses to remain flexible and responsive to changes in market conditions and internal operations.

- Activity-Based Budgeting: This method focuses on the costs of activities necessary to produce products or services, providing a more accurate picture of resource allocation.

Smarter Investment Choices Through Forecasting

Forecasting plays a critical role in enhancing investment decisions by projecting future financial performance based on historical data and market trends. By employing sophisticated forecasting techniques, businesses can make informed strategic choices that align with their growth objectives. Consider the following forecasting techniques:

- Trend Analysis: Examining historical data to identify patterns assists businesses in anticipating future sales and revenue shifts.

- Exponential Smoothing: This statistical technique gives more weight to recent data, making it useful for short-term forecasts that need to react swiftly to market changes.

- Scenario Planning: Developing various potential future scenarios allows businesses to prepare for different outcomes, helping mitigate risks associated with investment decisions.

- Predictive Analytics: Utilizing advanced algorithms and machine learning, predictive analytics can uncover hidden patterns in large datasets, providing insights that inform investment strategies.

Comparison of Traditional Budgeting Methods with Modern Financial Planning Approaches, How Financial Analysis Drives Smarter Business Purchasing and Investment Decisions

Understanding the distinction between traditional and modern budgeting methods is crucial for companies looking to enhance their financial planning. Traditional budgeting methods often rely on fixed allocations based on past expenditures, which can be inflexible in dynamic markets. In contrast, modern approaches emphasize adaptability and strategic alignment. Here’s a comparison:

| Traditional Budgeting | Modern Financial Planning |

|---|---|

| Fixed budgets based on historical data | Flexible, adaptive planning based on real-time data |

| Annual budget cycles | Rolling forecasts and continuous planning |

| Cost-cutting focus | Value creation and strategic investment |

| Departmental silos | Cross-functional collaboration and communication |

“Adopting modern financial planning techniques can lead to more accurate forecasting, better resource allocation, and ultimately, enhanced financial performance.”

Financial Modeling for Business Decisions

Financial modeling is a crucial aspect of strategic business planning that allows organizations to simulate various financial scenarios and make data-driven decisions. By creating detailed representations of a company’s financial performance, stakeholders can evaluate potential outcomes, assess risks, and optimize purchasing and investment strategies. This process not only aids in forecasting future financial conditions but also enhances overall decision-making efficacy.Building financial models involves several key steps, starting with defining the purpose and scope of the model, gathering historical data, and identifying the key variables that will influence outcomes.

After this, the construction phase includes organizing data into logical structures, applying appropriate formulas, and validating the model for accuracy. Financial models can take various forms to support different purchasing decisions, such as discounted cash flow (DCF) models, scenario analysis models, and sensitivity analysis models.

Examples of Financial Models for Purchasing Decisions

Financial models can greatly assist in evaluating purchasing options by providing transparency and clarity in the decision-making process. Here are some common examples:

1. Discounted Cash Flow (DCF) Model

This model estimates the value of an investment based on its expected future cash flows, discounted back to their present value. Businesses often use DCF to determine whether a purchase is financially viable by analyzing the net present value (NPV) of cash inflows versus outflows.

2. Break-even Analysis Model

This model helps businesses determine the minimum sales volume needed to cover costs associated with a new purchase. It provides insight into pricing strategies and sales targets necessary for profitability.

3. Cost-Benefit Analysis Model

This model evaluates the financial implications of a purchase by comparing the total expected costs to the anticipated benefits. It assists in identifying which purchasing option provides the highest return on investment (ROI).

4. Scenario Analysis Model

By simulating different market conditions, this model helps businesses understand the potential impact of various factors on their purchasing decisions. For instance, it can show how changes in prices or demand may affect profitability.

Best Practices in Financial Modeling for Accurate Projections

To ensure accuracy and reliability in financial modeling, adhering to best practices is essential. Implementing these strategies will enhance the robustness of your models and improve decision-making:

Maintain Clear Documentation

Every assumption, variable, and formula should be thoroughly documented within the model. This clarity allows for easier updates and helps users understand the underlying logic.

Use Consistent Formats

Consistency in data formatting and presentation enhances readability and minimizes the risk of errors. Use standardized templates and layout for key financial metrics.

Regularly Update the Model

Markets and conditions are constantly changing. Regular review and updates of financial models with the latest data ensure that projections remain relevant.

Incorporate Stress Testing

Testing the model under adverse conditions can help identify potential vulnerabilities. By running various scenarios, businesses can prepare for unexpected challenges.

Get Feedback from Stakeholders

Involving key stakeholders in the modeling process can provide diverse perspectives and enhance the model’s credibility. Their insights can uncover nuances that might otherwise be overlooked.

Effective financial modeling is a blend of analytical rigor and strategic foresight, essential for navigating complex business decisions.

Risk Management and Financial Strategy

In today’s dynamic business environment, effective risk management is integral to financial strategy and planning. By identifying potential financial threats and understanding their implications, organizations can make informed decisions that foster sustainability and growth. Risk assessment not only protects assets but also enhances the company’s reputation, potentially leading to better investment opportunities.The significance of risk assessment in financial planning cannot be overstated.

It serves as the backbone for developing robust financial strategies that align with organizational goals. By recognizing different types of risks—market, credit, operational, and liquidity—businesses can navigate the complexities of financial markets more effectively.

Importance of Risk Assessment in Financial Planning

A thorough risk assessment allows businesses to anticipate potential challenges and devise strategies to counteract them. The process involves analyzing both internal and external factors that could impact financial performance. A well-informed risk management strategy might include:

- Regularly updating financial forecasts to incorporate market changes.

- Conducting stress tests to evaluate the resilience of financial plans under adverse conditions.

- Implementing a diversified investment portfolio to spread risk across different assets.

The relationship between risk management and financial strategy is crucial for long-term success. Businesses that proactively assess and manage risk are better positioned to capitalize on opportunities while minimizing potential losses.

Strategies for Mitigating Financial Risk in Business Acquisitions

When acquiring companies, financial risk mitigation becomes paramount. Effective strategies include:

- Conducting comprehensive due diligence to uncover hidden liabilities.

- Valuing the target company accurately to avoid overpaying and to assess its financial health.

- Negotiating favorable terms that provide flexibility in case the acquisition does not align with performance expectations.

These techniques not only protect against unforeseen downturns but also facilitate smoother transitions during integrations.

Relationship Between Financial Strategy and Long-Term Success

Financial strategy must align with a company’s overall vision to ensure longevity and sustainability. A clear financial strategy focuses on:

- Establishing measurable financial goals that guide investment and operational decisions.

- Analyzing financial data to inform strategic pivots and adjustments.

- Engaging stakeholders in the financial planning process to foster a culture of accountability and transparency.

By integrating risk management with financial strategy, companies can create a resilient framework that supports growth and innovation while safeguarding their financial future.

Case Studies of Successful Financial Practices

In today’s fast-paced business environment, leveraging financial insights is paramount for companies aiming to enhance their purchasing and investment decisions. This section highlights notable case studies where businesses effectively utilized financial analysis to drive success, showcasing approaches that yielded significant improvements in operational efficiency and profitability.Real-world examples reveal the transformative power of financial insights in strategic decision-making processes. As companies navigated market complexities, they employed innovative financial strategies that not only improved their purchasing decisions but also optimized overall financial health.

The following case studies exemplify this trend and provide valuable lessons for businesses looking to refine their financial practices.

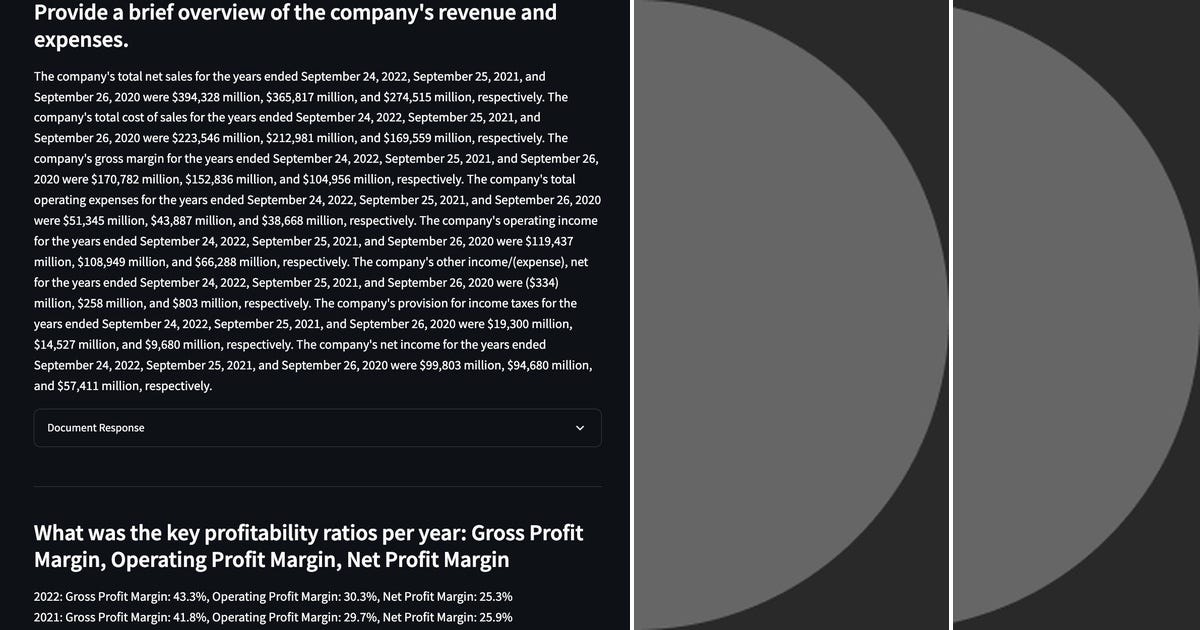

Analysis of Successful Case Studies

The following case studies illustrate how various companies leveraged financial insights to achieve their goals. Each case highlights the specific strategies employed and the outcomes realized.

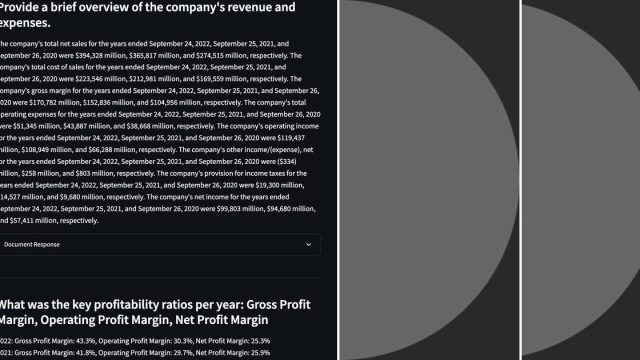

| Company | Strategy Implemented | Outcome | Lessons Learned |

|---|---|---|---|

| Company A | Data-Driven Purchasing Analysis | Reduced costs by 15% over three years | Importance of integrating data analytics in procurement decisions |

| Company B | Financial Forecasting Models | Increased ROI by 25% on capital expenditures | Precision in forecasting leads to better investment choices |

| Company C | Cash Flow Optimization Techniques | Improved cash flow by 30% within one year | Understanding cash flow dynamics is critical for liquidity management |

| Company D | Risk Management Framework | Minimized financial losses by 40% | Proactive risk management enhances long-term sustainability |

The strategies employed by these companies underscore the importance of adopting a systematic approach to financial analysis. By harnessing the power of data and applying rigorous financial practices, businesses can not only optimize their purchasing decisions but also improve their overall investment outcomes.

“Data-driven insights are the backbone of strategic financial management.”

Analyzing these successful case studies provides actionable insights for organizations aiming to refine their financial strategies. These examples serve as a guiding light for businesses striving for excellence in their financial decision-making processes.