Strategies for Selling Financial Investment Services in a Competitive Market are essential for navigating today’s ever-evolving financial landscape. Understanding the intricate dynamics of market trends, competitive forces, and client behaviors can elevate your investment services to new heights. The demand for financial advice is soaring, making it imperative for service providers to distinguish themselves amidst fierce competition. By identifying target markets and leveraging innovative marketing techniques, professionals can successfully attract and retain clients.

As we delve deeper, we will explore the significance of crafting a unique selling proposition, building lasting relationships, and employing technology and compliance practices that resonate with modern investors. This comprehensive guide aims to equip financial advisors with the tools necessary to thrive in a competitive marketplace.

Understanding the Financial Investment Market

The financial investment market is a complex and ever-evolving landscape that requires a keen understanding of current trends, competitive forces, and the unique challenges faced by service providers. In today’s dynamic environment, staying informed and adaptable is crucial for success.The current landscape of financial investment services is characterized by rapid technological advancements, increasing regulatory scrutiny, and shifting consumer preferences. Investors are now more informed and expect personalized solutions, which has led to the emergence of robo-advisors and digital platforms.

Additionally, trends such as sustainable investing and ESG (Environmental, Social, and Governance) criteria are gaining traction, compelling firms to integrate these principles into their offerings.

Competitive Forces Influencing the Financial Investment Sector

The financial investment sector is influenced by several competitive forces that shape market dynamics. Understanding these forces is essential for firms striving to maintain a competitive edge. The primary forces include:

- Market Saturation: The influx of new entrants and the proliferation of investment platforms have intensified competition, making differentiation paramount.

- Technological Innovation: Advancements in fintech are reshaping service delivery, enabling firms to offer faster, more efficient solutions.

- Regulatory Changes: Financial regulations are constantly evolving, requiring firms to adapt their strategies to remain compliant.

- Changing Consumer Expectations: Today’s investors demand transparency, lower fees, and tailored services, pushing firms to innovate continuously.

Key Challenges Faced by Financial Investment Service Providers

Financial investment service providers encounter a range of challenges in a competitive market. Recognizing and addressing these challenges is vital for sustaining growth. The notable challenges include:

- Maintaining Client Trust: With increasing scrutiny on investment products, building and maintaining trust with clients is more important than ever.

- Adapting to Market Volatility: Economic fluctuations can lead to abrupt changes in investor behavior, necessitating agile responses from firms.

- Recruiting and Retaining Talent: The need for skilled professionals is greater as firms seek to leverage advanced analytics and personalized services.

- Cost Management: As competition drives fee compression, firms must find ways to optimize operational efficiency while delivering value.

“In the financial investment landscape, adaptation and innovation are not just beneficial; they are essential for survival.”

The combination of a rapidly changing environment, intense competition, and evolving investor expectations creates a challenging but exciting arena for financial investment services. By understanding these dynamics, firms can better position themselves for success in this competitive market.

Target Market Identification

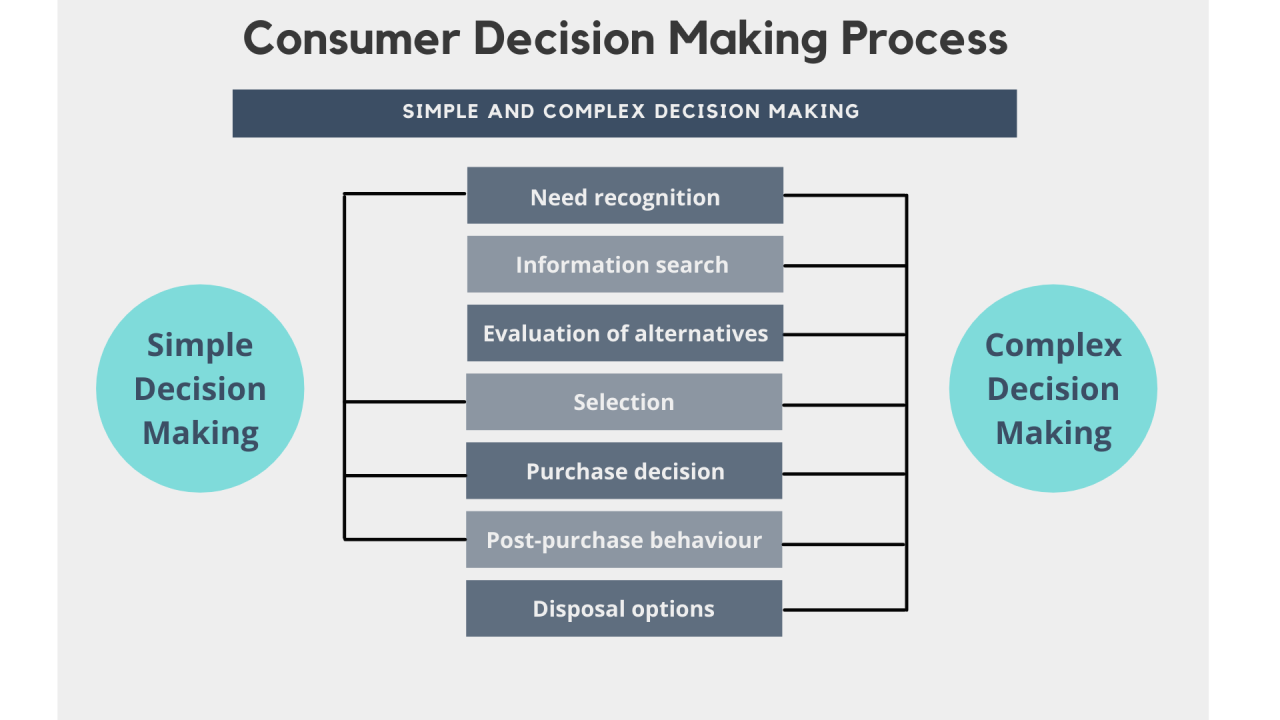

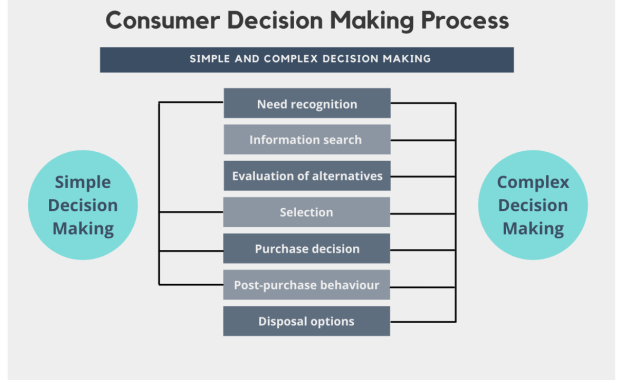

Identifying and segmenting potential clients for investment services is a crucial step in carving out a competitive advantage in the financial market. Understanding who your ideal customers are allows you to tailor your services to meet their specific needs and preferences.A systematic approach to target market identification involves defining the characteristics and demographics of potential clients, analyzing their investment behaviors, and segmenting them based on their unique needs.

This process not only aids in effectively reaching your audience but also enhances engagement and client satisfaction.

Methods for Segmenting Potential Clients

Segmenting your target market is essential for developing focused marketing strategies. The following methods can be employed to analyze client needs and preferences effectively:

- Demographic Analysis: Begin by gathering data on age, gender, income level, and education. For example, millennials might prefer technology-driven investment platforms, while older clients may favor traditional advisory services.

- Behavioral Analysis: Examine the investment habits of potential clients, including their risk tolerance and investment history. Understanding these patterns helps in tailoring services that align with their investment goals.

- Psychographic Segmentation: Look into the lifestyle, values, and attitudes of your clients. For instance, socially responsible investors will seek investment options that align with their ethical beliefs.

- Geographic Segmentation: Identify potential clients based on their location. Certain regions may have different economic conditions affecting investment preferences, such as real estate vs. stock market investments.

Recognizing these segments allows for personalized marketing messages that resonate more with potential clients, increasing the likelihood of engagement and investment.

Profile of an Ideal Customer

Creating a detailed profile of an ideal customer is instrumental in honing your marketing strategies. The following characteristics define an exemplary customer in the financial investment market:

- Name: John Doe

- Age: 35-50 years

- Income Level: $100,000 – $250,000 annually

- Investment Experience: Moderate to advanced, with a portfolio diversified across stocks, bonds, and ETFs.

- Investment Goals: Long-term wealth accumulation, retirement planning, and socially responsible investing.

- Preferred Communication: Technology-savvy, prefers digital platforms for transactions and information, with periodic face-to-face consultations.

Establishing such a profile enables financial service providers to develop tailored investment solutions that cater specifically to the needs of ideal customers. This focused approach enhances client satisfaction and fosters long-term loyalty within a competitive market.

Unique Selling Proposition (USP) Development

In a saturated financial market, a well-defined Unique Selling Proposition (USP) can set your investment services apart and attract a loyal clientele. A compelling USP encapsulates the specific benefits and advantages your services offer, distinguishing them from competitors and resonating deeply with potential clients. This element is crucial in making your firm memorable and trustworthy.Developing a compelling USP requires an in-depth understanding of your target market, including their needs, preferences, and pain points.

Begin by conducting thorough market research to identify gaps in the services offered by competitors. Utilize client feedback and industry trends to craft a message that speaks directly to the audiences you wish to serve. Your USP should convey a specific value proposition that not only highlights what makes your services unique but also addresses the specific financial goals of your clients.

Elements of a Strong USP, Strategies for Selling Financial Investment Services in a Competitive Market

A strong USP should be clear, concise, and directly address client needs. Here are some essential elements that contribute to a compelling USP:

- Specificity: Clearly articulate what makes your services unique. For example, a firm offering personalized investment strategies tailored to individual risk tolerances has a specific focus that sets it apart.

- Benefit-Oriented: Highlight the specific benefits clients will receive. A firm that promises “25% higher returns than industry average” immediately communicates a competitive edge.

- Credibility: Back your claims with statistics, testimonials, or case studies. For instance, showcasing real client success stories enhances trust and relatability.

- Emotional Appeal: Connect on an emotional level by addressing client aspirations, such as financial freedom or retirement security. A message like “Invest in your dreams” can resonate more than mere financial jargon.

Examples of Effective USPs in the Financial Industry

Some financial firms have successfully developed USPs that resonate with their target audience. The following examples illustrate how effective USPs can drive client engagement:

- Vanguard: “Brought to you by investors for investors.” This USP emphasizes the firm’s commitment to putting clients first, appealing to their desire for transparency and trust.

- Wealthfront: “The smarter way to invest.” Their focus on automated investment strategies attracts tech-savvy clients seeking efficiency and modern solutions.

- Fidelity: “Where investors come first.” This slogan positions Fidelity as a client-centric company, fostering a sense of reliability and commitment.

Comparative Approaches to Crafting a USP

Different approaches to developing a USP can lead to varying impacts on client acquisition and retention. Below is a comparison of several strategies:

- Feature-Based Approach: This method focuses on specific features of the service, such as low fees or advanced technology. While informative, it may fail to emotionally engage clients.

- Benefit-Driven Approach: This strategy emphasizes the benefits clients will receive, making it more relatable. Clients often respond better to messaging that prioritizes their needs and desires.

- Value Proposition Approach: Highlighting the overall value and return on investment (ROI) can be effective in attracting clients looking for tangible results. This method often includes measurable outcomes and statistics.

These varied approaches can significantly influence client acquisition strategies. A feature-based USP may attract clients focused solely on cost, while a benefit-driven USP could foster long-term relationships through emotional connections. Understanding the nuances of each approach allows firms to tailor their messaging effectively, ultimately enhancing client acquisition success.

Marketing Strategies for Financial Investment Services

In the competitive realm of financial investment services, effective marketing strategies are crucial for attracting and retaining clients. The integration of digital channels, educational content, and social media engagement can significantly enhance visibility and trust among potential clients. This section delves into tailored marketing strategies that resonate with the target audience, offering insights into the best practices for promoting financial services.

Digital Marketing Strategy for Financial Investment Services

A robust digital marketing strategy is essential for financial investment services to thrive in a crowded marketplace. Key elements of this strategy include:

- Optimization: Employing search engine optimization techniques to improve visibility on search engines. This involves using relevant s related to financial investment options, ensuring potential clients can easily find your services when searching online.

- Email Marketing: Building an email database to send tailored newsletters and updates. This can include investment tips, market analysis, and service promotions, helping to maintain engagement with current and prospective clients.

- PPC Advertising: Utilizing pay-per-click advertising to target specific demographics actively seeking financial services. This allows for a measurable return on investment and direct client acquisition.

Content Marketing for Educating Potential Clients

Content marketing plays a pivotal role in educating clients about their investment choices. By providing valuable information, firms can position themselves as trusted advisors. Effective methods include:

- Blog Posts: Writing informative articles that address common investment concerns and trends. Topics might include retirement planning, risk management, and portfolio diversification.

- Webinars: Hosting live webinars to discuss market trends and investment strategies. This interactive format allows for real-time questions and builds a community around your brand.

- White Papers: Producing in-depth reports on market analysis or investment strategies establishes authority and can be used to capture leads through gated content.

Effective Social Media Platforms for Financial Services Promotion

Choosing the right social media platforms is crucial for reaching the target market effectively. The most impactful platforms for promoting financial services include:

- LinkedIn: As a professional networking site, LinkedIn provides an ideal platform for connecting with business clients, sharing industry insights, and establishing professional credibility.

- Facebook: Facebook’s advertising tools enable targeted marketing campaigns, allowing firms to reach specific demographics and interests. Engaging content can foster community and discussion around financial topics.

- Twitter: This platform is effective for real-time updates and engaging with a broader audience. Sharing news, market updates, and quick investment tips can enhance brand visibility.

Relationship Building and Networking

In the competitive landscape of financial investment services, establishing strong relationships and effective networking is essential for sustained success. Financial professionals benefit significantly from a well-crafted networking strategy that fosters trust and loyalty among clients. This segment explores effective networking tactics and highlights the importance of referrals in enhancing client acquisition.

Effective Networking Strategies for Financial Investment Professionals

Building a robust network is vital for financial investment professionals. Engaging in diverse networking opportunities can lead to valuable connections and potential clients. Here are proven strategies for effective networking:

- Attend Industry Conferences: Participating in conferences allows professionals to connect with peers and industry leaders while staying updated on market trends.

- Join Professional Associations: Becoming a member of financial associations enables access to a broader network and various resources that can aid in business growth.

- Leverage Online Platforms: Utilizing social media platforms like LinkedIn fosters connections and facilitates discussions with other investment professionals and potential clients.

- Host Informative Workshops: Organizing workshops positions you as an expert in your field, attracting potential clients and building rapport through shared knowledge.

Building Long-Term Client Relationships and Trust

Long-term client relationships hinge on trust, which is cultivated through consistent communication and transparency. Financial professionals should implement the following techniques to enhance client relationships:

- Regular Check-ins: Schedule periodic meetings to discuss client portfolios and address any concerns, ensuring clients feel valued and informed.

- Provide Tailored Solutions: Personalizing investment strategies based on individual client goals reinforces the sense of partnership and commitment.

- Share Market Insights: Keeping clients informed about market conditions and trends not only educates them but also demonstrates your expertise and dedication.

- Solicit Feedback: Actively asking clients for their opinions on services provided shows that their satisfaction matters, leading to improved service delivery.

The Role of Referrals in Acquiring New Clients

Referrals serve as a powerful tool for client acquisition in the financial sector. They leverage existing client satisfaction to attract new business. The following insights elaborate on the significance of referrals:

- Trust Factor: Prospective clients are more likely to engage services that have been recommended by someone they trust, enhancing the likelihood of conversion.

- Client Incentives: Implementing referral programs that reward existing clients for introducing new clients can significantly increase referral rates.

- Building a Referral Network: Establishing partnerships with non-competing professionals in related fields can create a mutually beneficial referral system.

- Ask for Referrals: Simply asking satisfied clients for referrals can lead to new business opportunities, as many clients are willing to help if they are pleased with your services.

Compliance and Ethical Selling Practices

In the financial investment industry, compliance and ethical selling practices are not just regulatory requirements but essential components of building trust and credibility with clients. Adhering to compliance standards safeguards the interests of both the client and the advisor, ensuring a transparent and fair investment environment. By implementing ethical practices, financial advisors can foster long-term relationships built on integrity, ultimately leading to a successful business.Regulatory compliance involves adhering to laws and regulations that govern the financial investment sector.

This ensures that financial advisors operate within legal frameworks, protecting clients from fraudulent activities and unethical practices. Maintaining high ethical standards in client interactions is crucial for establishing trust, which is foundational in a highly competitive market. Ethical selling practices not only enhance the advisor’s reputation but also mitigate the risk of legal actions and penalties.

Importance of Compliance in Selling Financial Investment Services

Compliance is vital in the financial services industry, as it protects both clients and advisors and enhances the industry’s overall integrity. Understanding and adhering to guidelines set by regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA) is imperative. Financial advisors must prioritize compliance to ensure legal adherence and to cultivate a reputation for honesty and reliability.Among the key reasons compliance is essential are the following:

- Risk Mitigation: Compliance reduces the risk of legal actions against advisors, which can result in financial penalties and reputational damage.

- Client Protection: Regulatory frameworks are designed to protect investors from fraud and misrepresentation, thereby fostering a safe investment environment.

- Market Integrity: Compliance helps maintain a level playing field in the financial markets, promoting fair competition among investment services.

Best Practices for Maintaining Ethical Standards in Client Interactions

Establishing ethical standards in client interactions is crucial for financial advisors to build lasting relationships and ensure client satisfaction. Implementing best practices can lead to enhanced loyalty and trust from clients. It is essential to be transparent, honest, and respectful in all communications while prioritizing the client’s best interests.Key practices to maintain ethical standards include:

- Clear Communication: Always provide clients with clear, accurate, and comprehensive information regarding investment products and services.

- Transparency: Disclose any potential conflicts of interest and ensure clients understand the risks associated with their investments.

- Client-Centric Approach: Focus on clients’ needs and objectives, tailoring recommendations that align with their financial goals.

- Ongoing Education: Regularly educate clients about market trends and investment strategies to empower them in their financial decision-making.

Common Ethical Dilemmas Faced by Financial Advisors

Financial advisors often encounter ethical dilemmas that require careful consideration and resolution. Addressing these dilemmas is vital for maintaining a strong ethical foundation and protecting client interests. Common dilemmas include situations involving conflicts of interest, pressure to meet sales targets, or the temptation to recommend unsuitable investments for personal gain.Strategies to address ethical dilemmas include:

- Consultation with Compliance Teams: Advisors should regularly consult with compliance officers or legal teams when faced with ethical uncertainties.

- Establishing a Code of Ethics: Implementing a code of ethics within the advisory firm can guide decision-making and reinforce the importance of ethical behavior.

- Seeking Peer Input: Engaging with colleagues for advice can provide different perspectives and help navigate difficult situations.

- Continual Training: Regular training sessions on ethics and compliance can equip advisors with the tools to handle dilemmas effectively.

Leveraging Technology for Competitive Advantage

In today’s fast-paced financial landscape, leveraging technology is essential for delivering superior investment services and maintaining a competitive edge. Financial advisors and firms can utilize various technological tools to enhance service delivery, streamline processes, and gain deeper insights into market dynamics and client preferences. By embracing the latest advancements, organizations can position themselves as leaders in the financial investment sector, effectively responding to the needs of their clients and achieving business growth.

Technological Tools for Enhanced Service Delivery

Implementing cutting-edge technological tools can significantly improve the efficiency and effectiveness of service delivery in financial investment services. These tools include:

- Robo-Advisors: Automated investment platforms that provide algorithm-based portfolio management and advice, making investment services more accessible and cost-effective for a broader audience.

- Mobile Applications: User-friendly apps that allow clients to monitor their investments, access real-time market data, and execute trades directly from their smartphones, improving client engagement and satisfaction.

- Blockchain Technology: Enhances transaction transparency and security, which can lead to increased trust and reduced costs in investment transactions.

- Virtual Reality (VR) and Augmented Reality (AR): Innovative tools for immersive presentations and simulations that help clients better understand complex investment strategies and products.

Utilizing Data Analytics for Market Insights

Data analytics plays a pivotal role in understanding market trends and client behavior. By analyzing vast amounts of data, financial firms can uncover actionable insights that inform their strategies and improve service delivery. Key applications of data analytics include:

- Market Trend Analysis: Identifying emerging trends and shifts in investor sentiment, enabling firms to adjust their strategies proactively.

- Client Segmentation: Using demographic and behavioral data to create detailed profiles of clients, allowing for tailored marketing and service offerings that address specific needs.

- Predictive Analytics: Forecasting future market movements and investment outcomes based on historical data, thus aiding in informed decision-making.

- Performance Measurement: Evaluating investment strategies and portfolio performance through quantitative metrics to enhance overall service quality and client satisfaction.

Role of Customer Relationship Management (CRM) Systems

Customer Relationship Management (CRM) systems are vital for optimizing sales processes and enhancing client relationships in the financial investment sector. These systems provide a centralized platform for managing client interactions, tracking leads, and streamlining communications. The importance of CRM systems is evident in several key features:

- Centralized Client Information: A comprehensive database that stores essential client details, investment history, and preferences, enabling personalized service delivery.

- Automated Communications: Tools for scheduling follow-ups, sending reminders, and automating email campaigns, which enhance engagement and keep clients informed.

- Sales Tracking and Reporting: Features that track leads through the sales funnel, enabling teams to analyze performance and refine their sales strategies effectively.

- Integration with Other Tools: Seamlessly connecting with financial planning software, marketing platforms, and data analytics tools to provide a holistic view of client interactions and business performance.

Performance Measurement and Improvement: Strategies For Selling Financial Investment Services In A Competitive Market

Effective performance measurement is crucial for any financial investment service looking to thrive in a competitive market. By systematically evaluating sales strategies, businesses can identify strengths and weaknesses, ultimately refining their approaches for greater success. This segment will delve into key performance indicators (KPIs) that assess sales effectiveness, establishing a framework for continuous improvement, and exploring exemplary case studies that highlight successful application of these concepts.

Key Performance Indicators (KPIs) for Sales Strategy

Identifying the right KPIs is essential to monitor the effectiveness of sales strategies. These metrics can provide insights into sales performance and customer engagement, helping firms to make data-driven decisions. Common KPIs used in the financial investment sector include:

- Sales Growth: Measures the percentage increase in sales over a specific period, indicating the health and trajectory of the business.

- Customer Acquisition Cost (CAC): The total cost of acquiring a new customer, including marketing expenses, divided by the number of new customers gained in that period.

- Conversion Rate: The percentage of leads that turn into actual sales, reflecting the effectiveness of the sales process.

- Client Retention Rate: Indicates the percentage of clients retained over a period, showcasing customer satisfaction and service quality.

- Average Deal Size: The average revenue generated per closed deal, which can help assess revenue potential and sales tactics.

Framework for Continuous Improvement

A structured framework for continuous improvement in sales tactics is necessary for sustaining competitive advantage. This can be achieved through the following steps:

- Data Collection: Gather data from various sources, including CRM systems, client feedback, and market trends to inform decision-making.

- Analysis and Review: Regularly analyze KPI data to identify patterns and areas for improvement.

- Strategic Adjustments: Update sales strategies based on data insights, ensuring alignment with market conditions and client needs.

- Training and Development: Invest in ongoing training for sales teams to enhance skills and adapt to evolving market trends.

- Feedback Loop: Create a system for soliciting feedback from clients and team members to continuously refine approaches.

Case Studies of Effective Performance Measurement

Examining successful case studies can provide valuable lessons on the effective measurement and improvement of sales strategies. Consider the following example:

Company X, a financial advisory firm, implemented a robust KPI tracking system that resulted in a 25% increase in client acquisition within one year. By focusing on improving their conversion rate through targeted training and refined sales pitches, they significantly enhanced their overall performance.

Additionally, Company Y, a wealth management service, utilized client feedback surveys to identify service gaps. In response, they adjusted their service offerings, leading to a 40% increase in client retention over two years. Their commitment to understanding client needs through performance measurement solidified their market position.Incorporating these KPIs, frameworks, and real-life case studies into your financial investment service can lead to sustained growth and enhanced client relationships.

With the right tools and strategies in place, your firm can navigate the complexities of the competitive market successfully.