How Corporate Financial Planning Tools Support Strategic Purchasing Decisions is essential for any organization looking to optimize its purchasing strategies while ensuring financial stability. These tools play a crucial role in aligning corporate strategy with purchasing decisions, allowing businesses to forecast future financial performance. With a focus on accurate data and analysis, companies can make informed choices that directly impact their bottom line.

By employing the right financial planning tools, organizations can harness robust analytics that drive purchasing strategies, enabling them to effectively manage costs and mitigate risks. This integration not only enhances decision-making processes but also streamlines operations, positioning companies for success in a competitive marketplace.

Importance of Financial Planning in Corporate Strategy

In today’s dynamic business landscape, effective financial planning is not merely a support function but a cornerstone of strategic decision-making, especially in the realm of purchasing. Financial planning plays a vital role in ensuring that a company’s resources are aligned with its overarching goals and purchasing strategies, thus optimizing operational efficiency and fostering sustainable growth.The alignment of corporate strategy with purchasing decisions is critical for maintaining competitive advantage.

Financial planning tools provide the necessary framework for forecasting future financial performance, which in turn influences purchasing strategies. These tools analyze historical data and project future trends, enabling organizations to make informed decisions that align with their strategic objectives. For instance, utilizing advanced financial modeling software allows businesses to simulate varying purchasing scenarios, evaluating the potential impacts on cash flow and profitability.

Role of Financial Planning Tools in Forecasting

The application of financial planning tools is essential for forecasting future financial performance, which directly impacts purchasing strategies. These tools empower organizations to assess various financial scenarios, understand market dynamics, and predict how changes in purchasing decisions will affect overall financial health. Key benefits of financial planning tools include:

- Enhanced Accuracy in Forecasting: By using historical data and predictive analytics, companies can generate accurate forecasts of sales, expenses, and cash flow, ensuring that purchasing decisions are based on reliable insights.

- Scenario Analysis: Financial planning tools enable businesses to simulate different purchasing strategies under various market conditions, allowing for the evaluation of potential risks and rewards.

- Resource Allocation: With precise forecasts, organizations can allocate resources effectively, ensuring that capital is directed towards the most beneficial purchasing opportunities.

The significance of accurate data in financial planning cannot be overstated. High-quality, real-time data serves as the foundation for sound decision-making. Companies that leverage accurate financial information can achieve greater agility in their purchasing processes, responding swiftly to market changes.

“Accurate financial data transforms purchasing from a tactical function into a strategic enabler, driving profitability and growth.”

Incorporating sophisticated financial planning tools into corporate strategy elevates the purchasing function, allowing organizations to not only anticipate market trends but also to strategically position themselves for future success. This proactive approach fosters an environment where purchasing decisions are tightly integrated with the company’s financial health and strategic objectives.

Types of Financial Planning Tools

In the dynamic landscape of corporate finance, various financial planning tools play a crucial role in supporting purchasing decisions. These tools help organizations analyze their financial status, forecast future performance, and make informed purchases that align with their strategic goals. By leveraging technology, companies can enhance their decision-making processes, ensuring that every dollar spent is an investment toward growth and sustainability.Different financial planning tools come equipped with unique functionalities designed to improve accuracy and efficiency in planning and analysis.

These tools can range from basic spreadsheet applications to sophisticated software platforms that offer comprehensive financial modeling, forecasting, and reporting capabilities. The right tool can streamline operations and provide valuable insights that facilitate strategic purchasing.

Financial Planning Software Options

A variety of software options are available to assist corporations in their financial planning endeavors. Understanding these options allows organizations to select the most appropriate tools tailored to their specific needs. The following list Artikels some of the leading software solutions in the market today:

- Oracle Planning and Budgeting Cloud: A robust platform that offers extensive modeling capabilities and integrates seamlessly with existing systems, enhancing data visibility across departments.

- SAP Analytics Cloud: This tool combines business intelligence and planning in a single solution, allowing for real-time data analysis and collaborative planning processes.

- Adaptive Insights: Known for its user-friendly interface, this software focuses on budgeting, forecasting, and reporting, making it ideal for companies of all sizes.

- Microsoft Excel: While not a specialized financial tool, Excel remains widely used for its versatility and extensive array of functions, allowing organizations to create custom financial models.

- IBM Planning Analytics: This tool utilizes AI to enhance forecasting accuracy and integrates with various data sources, enabling dynamic financial planning.

The selection of the right software depends on factors such as company size, industry, and specific financial needs.

Integration of Financial Planning Tools, How Corporate Financial Planning Tools Support Strategic Purchasing Decisions

Integrating financial planning tools into existing purchasing processes can enhance operational efficiency and decision-making. When tools are effectively linked with procurement systems, organizations can achieve a holistic view of their financial health while ensuring alignment with purchasing strategies. Key aspects of this integration include:

Data Synchronization Ensuring that financial data is consistently updated across platforms minimizes errors and discrepancies, leading to more accurate purchasing decisions.

Scenario Planning By using financial planning tools, companies can simulate various purchasing scenarios, assessing potential outcomes before committing resources.

Budget Tracking Integrated tools allow for real-time monitoring of spending against budgets, helping organizations to stay within financial constraints while pursuing strategic purchases.

Automated Reporting Automation features streamline the reporting process, providing stakeholders with timely insights into financial performance related to purchasing activities.

“Integrating financial planning tools into purchasing processes transforms decision-making, making it data-driven and strategic.”

Successful implementation of these integrations requires careful planning and consideration of the unique workflows of the organization. By fostering collaboration between finance and procurement teams, companies can maximize the effectiveness of their financial planning tools, ensuring that every purchasing decision is grounded in solid financial analysis and strategic foresight.

Integrating Financial Planning with Purchasing Strategies: How Corporate Financial Planning Tools Support Strategic Purchasing Decisions

Integrating financial planning with purchasing strategies is essential for organizations aiming to maximize their efficiency and cost-effectiveness. This synergy enables purchasing departments to align their buying decisions with the overall financial objectives of the company, ensuring that resources are allocated wisely and investments yield substantial returns.The integration process begins with a comprehensive collection and analysis of financial data, which is then utilized to inform purchasing strategies.

In doing so, companies can anticipate future cash flows, assess budget constraints, and evaluate the financial implications of purchasing decisions. By leveraging financial forecasts, organizations can make informed choices that align their purchasing activities with broader corporate goals.

Methods for Incorporating Financial Forecasts in Purchasing Decisions

To ensure that purchasing decisions are underpinned by accurate financial forecasts, organizations can implement several effective methods. These strategies not only enhance the reliability of purchasing decisions but also ensure that they contribute positively to the overall financial health of the company.

Collaboration between financial planning teams and purchasing departments

This collaboration fosters a mutual understanding of financial goals and purchasing needs, creating a cohesive approach to decision-making.

Utilizing advanced financial planning tools

Tools such as predictive analytics and budgeting software can provide real-time data, enabling purchasing teams to adapt to changing economic conditions efficiently.

Establishing key performance indicators (KPIs)

Defining and monitoring KPIs related to both financial performance and purchasing efficiency ensures that decisions are consistently aligned with corporate objectives.

Step-by-Step Guide to Aligning Purchasing Departments with Financial Planning Teams

Aligning purchasing departments with financial planning teams is crucial for creating a seamless integration of strategies. Below is a step-by-step guide that Artikels how organizations can achieve this goal effectively.

1. Initiate Cross-Departmental Meetings

Regular meetings between financial planners and purchasing staff promote open communication and mutual understanding of each department’s objectives.

2. Define Common Goals

Establish shared goals that reflect both financial and purchasing priorities, ensuring that all team members understand their roles in achieving these objectives.

3. Share Financial Data

Ensure that purchasing teams have access to financial forecasts, budgets, and cash flow analyses to inform their purchasing strategies.

4. Implement Integrated Software Solutions

Utilize enterprise resource planning (ERP) systems that combine financial and purchasing data, providing a holistic view of the organization’s operations.

5. Train Teams on Financial Acumen

Provide training to purchasing staff on financial principles and metrics to enable them to assess the financial impact of their decisions effectively.

6. Monitor and Evaluate Outcomes

Regularly assess the performance of purchasing decisions against financial forecasts and objectives, adjusting strategies as necessary to improve alignment and outcomes.By following these steps, companies can achieve a robust integration of financial planning with purchasing strategies, driving efficiencies and fostering long-term financial success.

Benefits of Using Financial Planning Tools for Purchasing Decisions

In the evolving landscape of corporate finance, financial planning tools play a pivotal role in enhancing the effectiveness of purchasing decisions. These tools not only streamline purchasing processes but also empower organizations with the insights necessary to make informed strategic choices. As organizations seek to optimize their purchasing functions, the benefits derived from utilizing financial planning tools become increasingly evident, leading to more efficient operations and improved financial outcomes.Streamlined purchasing decisions are a significant advantage of integrating financial planning tools.

These tools offer comprehensive visibility into budgets, forecasts, and spending patterns, enabling purchasing managers to swiftly analyze options and make timely decisions. By automating data collection and analysis, organizations can reduce the time spent on manual processes, allowing for a more agile response to market changes. The outcome is a purchasing function that is not only faster but also more aligned with the overall corporate strategy.

Risk Management and Cost Control in Purchasing Functions

Effective risk management and cost control are essential components of successful purchasing strategies. Financial planning tools significantly enhance these aspects by providing real-time data analytics, scenario modeling, and forecasting capabilities. These functionalities allow organizations to identify potential risks associated with suppliers, pricing fluctuations, and market conditions before committing to purchasing decisions. The importance of these tools can be illustrated through the following benefits:

- Enhanced Visibility: Financial planning tools deliver insights into spending patterns, helping organizations track expenditures and identify areas for potential savings.

- Scenario Analysis: By simulating different purchasing scenarios, companies can evaluate the financial impact of various purchasing decisions, allowing them to choose the most advantageous path.

- Supplier Risk Assessment: Tools can analyze supplier reliability and market conditions, enabling businesses to mitigate risks associated with vendor relationships.

- Budget Adherence: By closely monitoring budgets, organizations can ensure that purchasing decisions align with financial objectives, reducing the likelihood of overspending.

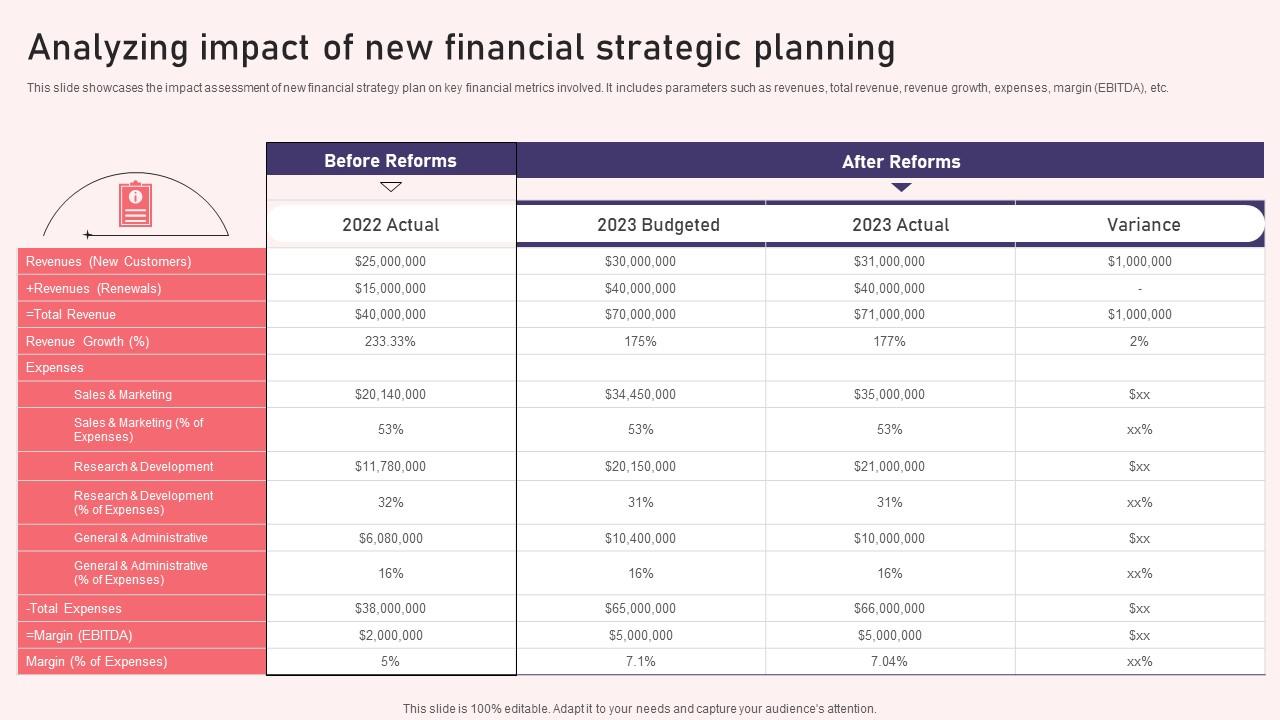

A compelling case study exemplifying the successful implementation of financial planning tools in purchasing decisions is the experience of a leading consumer electronics company. This organization utilized a financial planning tool to refine its procurement strategy, incorporating risk assessments and real-time data. As a result, the company achieved a 15% reduction in purchasing costs over two years while improving supplier performance metrics.

The integration of financial planning tools allowed them to make data-driven decisions that enhanced their competitive edge in the market.Another case involves a global manufacturing firm that faced challenges with fluctuating raw material costs. By employing financial planning tools to forecast price trends and analyze supplier contracts, the company successfully negotiated better terms with its suppliers. This proactive approach resulted in a 20% decrease in raw material expenses, showcasing the direct impact of financial planning on purchasing efficiency and cost control.In summary, leveraging financial planning tools not only streamlines purchasing decisions but also significantly aids in managing risks and controlling costs.

The integration of these tools into purchasing functions provides organizations with invaluable insights, leading to more strategic purchasing choices and improved overall performance.

Challenges in Financial Planning for Purchasing

The integration of financial planning tools into purchasing decisions brings about numerous advantages; however, it also presents several challenges that organizations must navigate. Identifying and overcoming these challenges is crucial for optimizing purchasing strategies and enhancing overall corporate efficiency. Effective financial planning for purchasing involves a complex interplay of data, forecasting, and strategic alignment. Organizations often struggle with various obstacles that can hinder their ability to make informed purchasing decisions.

Common challenges include data silos, a lack of real-time analytics, integration issues with existing systems, and resistance to change among staff.

Common Challenges in Utilizing Financial Planning Tools

Understanding the common challenges organizations face is the first step toward effective solutions. The following points highlight key obstacles to successful financial planning for purchasing:

- Data Quality Issues: Inaccurate or incomplete data can lead to faulty financial assessments and misguided purchasing decisions.

- Integration Difficulties: Poor integration of financial planning tools with existing purchasing systems can create inefficiencies and data discrepancies.

- Training Gaps: Employees may lack the necessary skills to effectively use financial planning tools, leading to underutilization and misinterpretation of data.

- Resistance to Change: Staff may be reluctant to adopt new tools or processes, fearing they may complicate existing workflows.

- Insufficient Real-Time Analytics: Organizations often struggle to access real-time data, which is critical for timely purchasing decisions.

Strategies to Overcome Challenges

Organizations can implement specific strategies to mitigate the challenges associated with financial planning for purchasing. The importance of adopting a proactive approach cannot be overstated, as it leads to improved decision-making processes and greater operational efficiency.

- Enhancing Data Management: Ensure that data is regularly updated and validated for accuracy, creating a singular repository for all financial information.

- Investing in Integration Solutions: Utilize tools that seamlessly integrate existing financial planning software with purchasing systems to streamline processes.

- Providing Comprehensive Training: Develop training programs that empower staff to effectively use financial planning tools, fostering confidence and expertise.

- Encouraging a Culture of Adaptability: Promote an organizational culture that embraces change, emphasizing the benefits of new tools and processes.

- Leveraging Advanced Analytics: Invest in cutting-edge analytics solutions that provide real-time insights, enabling quicker and more informed purchasing decisions.

The Importance of Training and Resources

Training and adequate resources are essential components for successfully overcoming challenges in financial planning for purchasing. Ensuring that teams possess the necessary skills and knowledge can significantly improve decision-making processes.

“Empower your teams with the right training and tools; their expertise is your greatest asset in the financial planning landscape.”

Organizations should prioritize regular training sessions and workshops that focus on the latest financial planning tools and techniques. Additionally, providing resources such as manuals, FAQs, and access to expert consultations can further enhance team capabilities. By investing in human capital, organizations not only improve their financial planning abilities but also foster a collaborative environment that prioritizes effective purchasing strategies.

Future Trends in Corporate Financial Planning and Purchasing

In an ever-evolving business landscape, corporate financial planning and purchasing strategies are undergoing significant transformations. The integration of advanced technologies and innovative financial planning tools is reshaping how organizations approach their purchasing decisions. This section explores the emerging trends that will likely influence future practices in financial planning and purchasing.

Emerging Trends in Financial Planning Tools

The evolution of financial planning tools is being heavily influenced by advancements in technology, particularly in artificial intelligence (AI) and machine learning. These technologies are streamlining the financial planning process, offering organizations enhanced capabilities to analyze vast amounts of data and derive actionable insights. The primary trends shaping financial planning include:

- Predictive Analytics: Financial planning tools are increasingly incorporating predictive analytics, which allows organizations to forecast future purchasing needs based on historical data, market trends, and consumer behavior. This capability enables more strategic procurement decisions by anticipating changes in demand.

- Real-Time Data Integration: The ability to integrate real-time data from various sources, including supply chain management systems and market intelligence platforms, enhances the accuracy of financial forecasts. This integration supports timely and informed purchasing decisions.

- AI-Driven Scenario Analysis: Organizations are leveraging AI to conduct scenario analyses that evaluate potential purchasing outcomes based on different assumptions. This helps in understanding the implications of various strategies and making more informed choices.

- Cloud-Based Financial Planning Tools: The shift to cloud-based solutions provides flexibility and scalability, allowing teams to collaborate seamlessly across different locations. This transition supports dynamic financial planning processes that are adaptable to changing market conditions.

Impact of AI and Machine Learning on Financial Planning

AI and machine learning are revolutionizing financial planning by automating complex analytical processes and enhancing decision-making capabilities. These technologies enable organizations to process large data sets quickly, revealing insights that inform strategic purchasing decisions.Consider the following impacts:

- Enhanced Accuracy: By reducing human error in data analysis, AI ensures more accurate financial forecasts, thus enhancing the reliability of purchasing strategies.

- Cost Reduction: Automation of routine tasks in financial planning leads to reduced operational costs, allowing resources to be allocated toward strategic procurement initiatives.

- Supplier Risk Assessment: Machine learning algorithms can analyze supplier performance data, helping organizations assess risks and make informed purchasing decisions that mitigate potential supply chain disruptions.

Forecast of Corporate Purchasing Practices

The evolution of financial planning tools is expected to significantly influence corporate purchasing practices over the next few years. As organizations adapt to these innovations, several key predictions can be made:

- Increased Strategic Alignment: Financial planning will become increasingly aligned with corporate strategy, with procurement decisions being made in tandem with overall business objectives, ensuring that purchasing aligns with long-term goals.

- Greater Emphasis on Sustainability: As businesses face growing pressure to adopt sustainable practices, financial planning tools will incorporate sustainability metrics, guiding purchasing decisions toward greener suppliers and products.

- Enhanced Collaboration Across Departments: The integration of financial planning tools will foster collaboration between finance, procurement, and other departments, facilitating a more cohesive approach to purchasing decisions.

- Real-Time Adaptation: Organizations will develop the capability to adapt purchasing strategies in real time, responding swiftly to changes in market conditions and consumer preferences, thanks to advanced financial planning tools.

“Embracing advanced financial planning tools not only leads to better purchasing decisions but also positions organizations to thrive in an increasingly competitive market.”