Integrating Sales Forecasting into Corporate Financial Planning for Sustainable Growth sets the stage for an enthralling narrative that highlights the vital relationship between sales forecasting and financial planning. In today’s dynamic business landscape, accurate sales forecasting is more than just a crystal ball; it’s a strategic tool that empowers organizations to align their financial goals, anticipate market demands, and drive sustainable growth.

As we delve into the evolution of forecasting methodologies and the key drivers of accuracy, we uncover how these insights can create a robust financial blueprint for success.

This comprehensive exploration will illuminate the objectives of corporate financial planning, reveal the synergistic connection between sales forecasting and financial strategies, and introduce best practices for seamless integration. With advancements in technology and a focus on data analytics, organizations can enhance their forecasting capabilities and ensure their financial planning remains agile and responsive to market changes.

Introduction to Sales Forecasting

Sales forecasting is an essential component of corporate financial planning, providing businesses with insights into future revenue streams. Accurate forecasts can guide strategic decision-making, optimize resource allocation, and enhance overall financial performance. By anticipating market demand, companies can align their operations to meet customer needs while ensuring sustainable growth.The evolution of sales forecasting methodologies has transformed the way organizations approach market predictions.

Initially grounded in simple, historical data analysis, businesses have progressed to sophisticated models that incorporate predictive analytics and machine learning. These advanced methodologies allow for a more nuanced understanding of market trends and customer behaviors, significantly improving forecasting accuracy.

Factors Affecting Sales Forecasting Accuracy

A variety of factors influence the precision of sales forecasting, and understanding these can significantly enhance predictive capabilities. Identifying these elements helps organizations refine their forecasting processes and make more strategic financial decisions.

- Market Trends: Changes in consumer behavior, economic fluctuations, and industry shifts can dramatically impact sales. Businesses must stay attuned to market dynamics to adjust their forecasts accordingly.

- Data Quality: The reliability of the data used for forecasting directly affects accuracy. High-quality, comprehensive data collection practices are vital for generating actionable insights.

- Sales Team Input: Incorporating insights from frontline sales teams can provide valuable context and nuance to forecasts. Their experiences and knowledge of customer interactions can lead to more informed predictions.

- Technological Integration: Utilizing advanced forecasting software enhances data analysis capabilities, allowing for real-time adjustments based on the latest market information.

- External Factors: Elements such as competitive actions, regulatory changes, and macroeconomic conditions can introduce volatility, necessitating ongoing adjustments to forecasts.

“Accurate sales forecasting is not just about predicting numbers; it’s about understanding the story behind the data.”

The Role of Financial Planning in Organizations

In the dynamic landscape of modern business, financial planning serves as a critical pillar that supports organizational success. By establishing clear financial goals and strategies, corporations can navigate uncertainties and capitalize on opportunities, ensuring a path toward sustainable growth. This foundational process not only aligns resources with company objectives but also enhances decision-making across all levels of management.Effective financial planning is vital for fostering long-term sustainability and growth within organizations.

It enables firms to allocate resources efficiently, manage risks, and adapt to market changes. By creating a robust financial framework, companies can improve their ability to forecast revenues, control costs, and optimize investment strategies. As a result, organizations are better positioned to maintain competitive advantages and achieve fiscal stability, which is essential for enduring success.

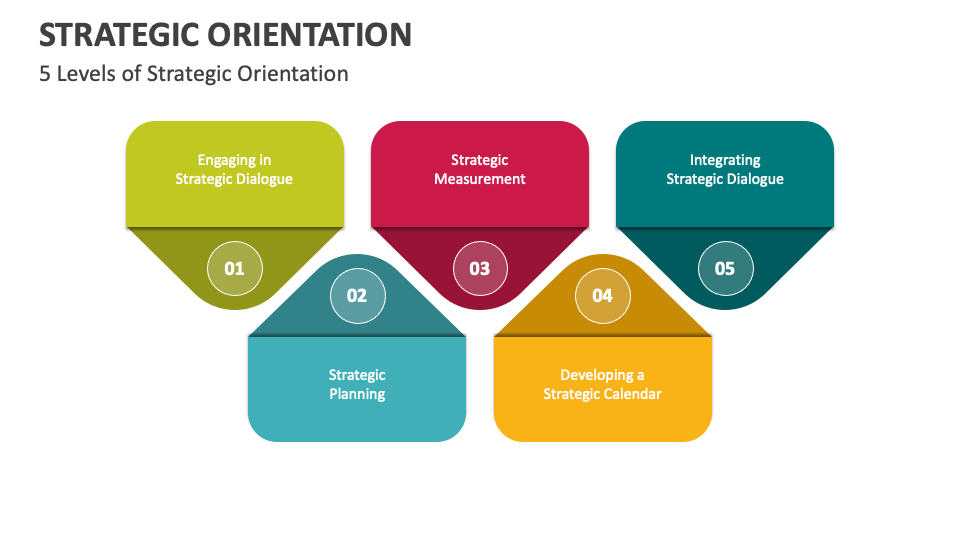

Objectives of Corporate Financial Planning

The primary objectives of corporate financial planning revolve around optimizing financial performance and ensuring that the organization can meet both short-term and long-term goals. These objectives include:

- Resource Allocation: Ensuring that financial resources are distributed effectively across various departments to maximize operational efficiency.

- Risk Management: Identifying potential financial risks and developing strategies to mitigate them, thereby safeguarding the organization’s assets.

- Profit Maximization: Establishing financial goals that focus on increasing profitability through efficient cost management and revenue enhancement strategies.

- Capital Investment Planning: Assessing and prioritizing investment opportunities that align with the company’s growth strategy and financial health.

- Cash Flow Management: Monitoring and managing cash flows to ensure liquidity and the ability to meet financial obligations as they arise.

Contribution of Effective Financial Planning to Sustainable Growth

Effective financial planning plays a pivotal role in ensuring that businesses achieve sustainable growth. This involves creating a structured approach that encompasses:

- Long-term Vision: Establishing a clear financial roadmap that articulates the company’s future objectives and growth strategy.

- Performance Measurement: Implementing metrics and benchmarks to evaluate financial performance, allowing for timely corrective actions if necessary.

- Scenario Analysis: Conducting analyses to prepare for potential economic fluctuations, enabling the organization to remain resilient in changing market conditions.

- Stakeholder Confidence: Boosting confidence among investors, employees, and other stakeholders by demonstrating financial stability and strategic foresight.

Interdependencies Between Financial Planning and Sales Forecasting

The relationship between financial planning and sales forecasting is vital for organizational coherence and strategic success. The integration of these two aspects enhances overall operational effectiveness by creating a unified approach to planning and execution. Several key interdependencies include:

- Informed Decision-Making: Financial planning relies heavily on accurate sales forecasts to make informed budgeting and investment decisions.

- Resource Alignment: Sales forecasts inform financial plans regarding resource allocation, ensuring that departments are adequately equipped to meet projected sales targets.

- Risk Assessment: Financial planning utilizes sales forecasts to identify potential revenue fluctuations, allowing for proactive risk management strategies.

- Performance Tracking: Continuous monitoring of sales forecasts against actual results informs financial adjustments, ensuring alignment with corporate objectives.

Integrating sales forecasting into financial planning creates a synergistic effect that enhances organizational resilience and drives sustainable growth.

Integrating Sales Forecasting with Financial Planning

The integration of sales forecasting with financial planning is a crucial element for organizations aiming to achieve sustainable growth. By aligning these two critical functions, businesses can ensure that their financial resources are effectively allocated to support sales initiatives, ultimately driving profitability and stability. This integration enables organizations to anticipate market trends, manage cash flow, and make informed strategic decisions.The process of integrating sales forecasts into financial planning cycles involves several key steps that bridge the gap between sales and finance teams.

This collaborative approach allows for a more accurate reflection of projected revenue in the financial planning process. The first step is to establish a regular communication schedule between the sales and finance departments to discuss projections and underlying assumptions. This ensures that both teams are on the same page regarding market conditions and business objectives.

Framework for Aligning Sales Forecasting with Financial Goals

Aligning sales forecasting with financial goals requires a structured framework that encompasses the entire organization. This framework includes the following essential elements:

1. Collaborative Goal Setting

Both sales and finance should jointly define revenue targets based on realistic market analysis and historical performance. This alignment fosters ownership and accountability across departments.

2. Data Synchronization

Utilizing a centralized data management system enables real-time access to sales data and financial performance metrics. This system should integrate various data sources, including CRM systems and ERP software, to enhance accuracy.

3. Continuous Review and Adjustment

It is vital to create a dynamic forecasting model that allows for continuous updates based on changing market conditions. Regular reviews of sales data against actual performance help in making timely adjustments to forecasts.

4. Performance Metrics

Establishing key performance indicators (KPIs) that reflect both sales and financial objectives ensures that all stakeholders are aligned and focused on common goals. Metrics such as revenue growth, profit margins, and customer acquisition costs should be monitored closely.

5. Feedback Loop

Implementing a structured feedback loop facilitates the flow of information between sales and finance, allowing for a more responsive approach to forecasting. This loop can include regular meetings or digital dashboards that track progress against targets.

“Effective integration of sales forecasting into financial planning is not just about numbers; it’s about fostering collaboration and alignment between teams.”

Best practices for collaboration between sales and finance teams are paramount for successful integration. These practices include:

Open Communication

Regularly scheduled meetings between sales and finance teams enhance understanding and cooperation. This communication helps break down silos and promotes a unified approach to business objectives.

Shared Technology Tools

Utilizing shared platforms such as cloud-based software allows both teams to access and analyze data collaboratively, leading to more informed decision-making.

Cross-Training

Encouraging team members to learn about each other’s functions creates empathy and better understanding of challenges faced by both departments. This can improve collaboration and lead to more effective forecasting.

Incentivizing Alignment

Creating incentive programs that reward both sales and finance for achieving integrated goals can further strengthen collaboration and drive performance.The integration of sales forecasting with financial planning is essential for organizations seeking to optimize their financial outcomes. By establishing a structured framework, fostering collaboration, and adhering to best practices, businesses can effectively align their sales and financial goals to achieve sustainable growth.

Tools and Technologies for Integration: Integrating Sales Forecasting Into Corporate Financial Planning For Sustainable Growth

In today’s fast-paced business landscape, effectively integrating sales forecasting and financial planning is crucial for sustainable growth. Leveraging the right tools and technologies can streamline this integration, providing organizations with the insights necessary for informed decision-making. Here, we explore key software solutions and innovative technologies that enhance the synergy between sales forecasting and financial planning.

Key Software Tools for Integration

A variety of software tools are available that facilitate the seamless integration of sales forecasting with financial planning, helping organizations to optimize their operations and improve accuracy.

- Salesforce: Known for its customer relationship management (CRM) capabilities, Salesforce offers advanced forecasting tools that can be integrated with financial planning modules, providing real-time sales data and insights.

- Oracle Business Planning Cloud: This comprehensive solution combines planning, forecasting, and budgeting in a single platform, allowing organizations to align their sales and financial strategies effectively.

- SAP Integrated Business Planning: SAP’s solution provides integrated sales and operations planning, enabling businesses to forecast sales while considering financial implications and resource allocations.

- Adaptive Insights: A cloud-based solution that supports financial planning and sales forecasting, Adaptive Insights allows for collaborative planning, offering robust analytical tools that enhance visibility across departments.

Leveraging Data Analytics in Sales Forecasting

Data analytics plays a pivotal role in enhancing the accuracy and reliability of sales forecasting. By transforming raw data into actionable insights, organizations can make informed decisions that drive growth.

- Utilizing historical sales data helps identify trends and patterns that can predict future sales performance accurately.

- Implementing predictive analytics allows businesses to anticipate market shifts and customer behaviors, thereby refining their forecasting models.

- Incorporating real-time data from various sources enhances the relevance of forecasts, ensuring they reflect current market conditions.

- Advanced visualization tools help stakeholders understand complex data sets quickly, leading to faster decision-making.

The Role of Artificial Intelligence in Enhancing Forecasting Accuracy

Artificial intelligence (AI) revolutionizes the way organizations approach sales forecasting by improving accuracy and efficiency through advanced algorithms.

- AI-driven models analyze vast amounts of historical and real-time data, significantly increasing the precision of forecasts.

- Machine learning algorithms continuously learn from new data, refining predictions over time and adapting to changing market dynamics.

- Natural language processing (NLP) allows for the analysis of unstructured data, such as customer feedback and market sentiment, enhancing the forecasting process.

- AI tools can automate routine tasks, freeing up valuable time for finance and sales teams to focus on strategic initiatives.

Challenges in Integration

Integrating sales forecasting into corporate financial planning is essential for achieving sustainable growth, yet it is fraught with challenges that can hinder success. Recognizing and addressing these obstacles can significantly enhance the effectiveness of both sales and financial strategies within an organization. The integration process often encounters several common obstacles, including data silos, misalignment of goals, and resistance to change among key stakeholders.

These challenges can create significant barriers that impede the flow of information and the collaboration necessary for successful integration.

Common Obstacles in Integration

Data silos occur when departments operate independently, leading to inconsistent and incomplete information. This fragmentation can result in forecasting inaccuracies, which can adversely affect financial planning. Misalignment of goals between sales and finance teams can create conflict, making it difficult to establish a unified strategy. Additionally, resistance to change often arises from employees who are accustomed to routine processes, hindering the implementation of new systems and practices.

To better understand these challenges, the following points illustrate specific obstacles organizations may face during integration:

- Data Silos: Inconsistent data from various departments can lead to forecasting inaccuracies, undermining effective financial planning.

- Misalignment of Goals: Different priorities between sales and finance can create conflicts that obstruct cohesive planning efforts.

- Resistance to Change: Employees may resist new processes, fearing disruption to established workflows and comfort zones.

Potential Pitfalls and Avoidance Strategies

Understanding potential pitfalls is crucial for avoiding integration failures. Some common pitfalls include poor communication among teams, lack of training on new tools, and failure to establish clear objectives. These issues can derail the integration process and lead to wasted resources. To combat these pitfalls, organizations should focus on several strategies:

- Enhancing Communication: Establish regular meetings and collaborative platforms to ensure all teams are aligned and informed throughout the integration process.

- Providing Training: Offer comprehensive training programs that prepare staff for new tools and processes, minimizing resistance and confusion.

- Setting Clear Objectives: Clearly defined goals can guide teams in their collaborative efforts, ensuring a focused and unified direction.

Overcoming Resistance to Change

Resistance to change is a significant hurdle in integrating sales forecasting with financial planning. Overcoming this resistance requires a strategic approach that emphasizes the benefits of integration. Engaging stakeholders early in the process and demonstrating how changes can lead to improved efficiency and profitability will foster buy-in. To effectively address resistance, consider the following strategies:

- Involve Stakeholders Early: Engage team members in the integration process from the outset, soliciting their input and addressing concerns to build ownership.

- Communicate Benefits: Clearly articulate how integration enhances performance, ultimately leading to better outcomes for the organization and individual teams.

- Celebrate Milestones: Acknowledge achievements throughout the integration process to maintain momentum and encourage continued commitment to change.

Case Studies of Successful Integration

In today’s competitive business landscape, the integration of sales forecasting into corporate financial planning is not just advantageous but essential for sustainable growth. Numerous companies have demonstrated how effectively combining these two critical components can lead to remarkable outcomes. This section highlights notable case studies showcasing successful integration methodologies and the tangible benefits realized.

Company A: Tech Innovations Inc.

Tech Innovations Inc., a leader in software development, implemented an integrated sales forecasting system alongside their financial planning processes. By utilizing predictive analytics, they aligned their sales data with financial projections, allowing them to anticipate market trends and adjust their strategies accordingly. The methodology employed involved:

- Utilizing machine learning algorithms to analyze historical sales data and customer behavior.

- Incorporating real-time data from various sales channels to enhance forecasting accuracy.

- Engaging cross-departmental teams, including sales, finance, and marketing, to ensure cohesive strategy development.

As a result of this integration, Tech Innovations saw a 20% increase in revenue within the first year, alongside improved inventory management and reduced operational costs.

Company B: Global Retail Corp.

Global Retail Corp., a multinational retail giant, successfully integrated sales forecasting with its financial planning by implementing an advanced enterprise resource planning (ERP) system that combined data from sales, finance, and supply chain management.The processes included:

- Adopting a centralized data management system that provided real-time visibility across all departments.

- Leveraging advanced statistical models to create accurate sales forecasts based on seasonal trends.

- Regular strategy review sessions that involved key stakeholders to adapt to market changes swiftly.

This approach resulted in reduced stockouts by 30% and a 15% increase in customer satisfaction, ultimately leading to higher sales figures and stronger market positioning.

Company C: Health Solutions Ltd.

Health Solutions Ltd., a healthcare provider, integrated their sales forecasting with financial planning through the use of data analytics and collaborative planning processes. This integration was crucial for aligning their service offerings with patient demand and financial viability.Key methodologies included:

- Implementing a robust data analytics platform that provided insights into patient trends and financial performance.

- Collaborating with healthcare professionals to fine-tune service offerings based on predictive sales data.

- Establishing a continuous feedback loop between sales and finance to refine forecasts and budgets.

The integration led to a 25% improvement in service utilization and a significant reduction in operational waste, aligning financial goals with patient needs.

“Successful integration of sales forecasting with financial planning not only enhances profitability but also strengthens organizational resilience in fluctuating markets.”

Measuring the Impact of Integration

In today’s competitive landscape, understanding the effects of integrating sales forecasting with financial planning is crucial for sustainable growth. Organizations that successfully measure this impact can better align their strategies, ensuring that both sales and finance work hand-in-hand for maximum efficiency and profitability. By establishing solid metrics, businesses can track performance improvements and understand the long-term benefits of their integrated approach.To effectively evaluate the success of integrated sales forecasting and financial planning, key performance indicators (KPIs) serve as essential benchmarks.

These metrics not only provide insights into current performance but also highlight areas for future growth. The primary KPIs to consider include:

Key Performance Indicators for Integration

Establishing KPIs allows organizations to quantify the effectiveness of their integrated systems. The following KPIs are vital for assessing integration success:

- Forecast Accuracy: This metric measures how closely actual sales align with forecasted sales, providing a direct indicator of the effectiveness of sales forecasting.

- Revenue Growth Rate: Tracking the growth rate over time pre- and post-integration reveals the impact of alignment on financial performance.

- Cost of Sales: Understanding the cost structure relative to sales can illustrate efficiencies gained from better forecasting and financial planning.

- Operating Margin: This KPI measures profitability by examining the relationship between revenue and operational costs, reflecting the financial health post-integration.

- Customer Satisfaction Index: Increased alignment can lead to improved service delivery, which is reflected in customer satisfaction metrics.

These KPIs not only measure current success but also provide a framework for assessing the long-term impacts on organizational growth.

Assessment of Long-Term Impacts

To gauge the long-term effects of integrating sales forecasting with financial planning, organizations should adopt a comprehensive assessment strategy. This can include both qualitative and quantitative methods, ensuring a well-rounded evaluation of organizational growth.A structured approach might involve the following steps:

- Benchmarking: Compare performance metrics from before and after integration to establish a clear picture of improvement.

- Trend Analysis: Observe trends over multiple periods to identify sustained growth patterns and deviations.

- Feedback Loops: Implement mechanisms to regularly gather input from stakeholders on the efficiency and effectiveness of integrated processes.

- Financial Health Checks: Regular audits to assess the financial health post-integration will reveal the integration’s impact on overall corporate performance.

By focusing on these assessment methods, organizations can acquire a profound understanding of how integration influences their strategic objectives.

Comparison of Pre- and Post-Integration Performance Metrics, Integrating Sales Forecasting into Corporate Financial Planning for Sustainable Growth

A critical part of measuring the impact of integration lies in comparing pre- and post-integration performance metrics. This comparison offers a clear view of the value added by integration efforts.

| Metric | Pre-Integration | Post-Integration |

|---|---|---|

| Forecast Accuracy (%) | 70% | 85% |

| Revenue Growth Rate (%) | 5% | 12% |

| Cost of Sales (% of Revenue) | 30% | 25% |

| Operating Margin (%) | 15% | 22% |

| Customer Satisfaction Index | 75 | 90 |

This table illustrates the marked improvement across key metrics, showcasing how integration has propelled the organization towards achieving its goals more efficiently. Organizations that regularly measure these metrics can not only celebrate their successes but also identify ongoing challenges that need addressing to sustain their growth trajectory.

Future Trends in Sales Forecasting and Financial Planning

The landscape of sales forecasting and financial planning is evolving rapidly as organizations strive to attain sustainable growth in an increasingly competitive market. Understanding the future trends in these domains is crucial for businesses aiming to remain agile and responsive to market dynamics. With advanced technologies and innovative methodologies emerging, the potential for enhanced accuracy and strategic alignment in financial planning is boundless.New technologies are significantly reshaping forecasting methods, bringing about a paradigm shift in how organizations approach sales forecasting.

One of the most notable trends is the integration of artificial intelligence (AI) and machine learning (ML) into forecasting models. These technologies enhance predictive accuracy by analyzing vast amounts of data and identifying patterns that traditional methods may overlook.

Emerging Trends in Sales Forecasting

Organizations are witnessing a transformation in sales forecasting practices, driven by various emerging trends that are likely to influence financial planning.

- Data-Driven Decision Making: The reliance on data analytics continues to grow, allowing companies to make informed decisions based on historical performance and predictive trends.

- Real-Time Forecasting: The demand for agility necessitates real-time data evaluation, enabling businesses to adjust forecasts based on the latest market changes.

- Collaborative Forecasting: Cross-functional teams are increasingly collaborating in the forecasting process, integrating insights from sales, marketing, finance, and operations for more comprehensive models.

- Scenario Planning: Organizations are adopting scenario planning to prepare for various market conditions, enhancing their ability to navigate uncertainties.

- Customer-Centric Forecasting: Understanding customer behavior and preferences is becoming a focal point, driving more accurate predictions that align with consumer demand.

The impact of these trends on financial planning is profound, as organizations must adapt their strategies to remain competitive.

Impact of New Technologies on Forecasting Methods

The adoption of cutting-edge technologies is revolutionizing how sales forecasts are generated and utilized in financial planning. Here are some key technological advancements that are reshaping the landscape:

- Artificial Intelligence: AI algorithms are capable of analyzing complex datasets, identifying trends, and generating forecasts with higher accuracy than traditional methods. For instance, companies like Amazon utilize AI to predict sales trends based on consumer behavior.

- Predictive Analytics: Predictive analytics tools leverage past data to forecast future outcomes, allowing businesses to anticipate demand fluctuations and adjust their financial strategies accordingly.

- Cloud-Based Solutions: Cloud technologies facilitate real-time data sharing and collaboration across departments, enhancing the forecasting process and allowing for dynamic adjustments to financial plans.

- Big Data Technologies: The ability to process and analyze massive data sets enables organizations to glean actionable insights, leading to more precise forecasting and improved resource allocation.

Adopting these technologies can significantly improve the integration of sales forecasting into financial planning, enabling organizations to make data-driven decisions.

Preparation for Future Changes

Organizations looking to thrive amidst these emerging trends should take proactive steps to ensure they are well-prepared for the future of sales forecasting and financial planning. Key strategies to consider include:

- Investing in Technology: Organizations need to invest in state-of-the-art forecasting tools and technologies that support advanced analytics and real-time data processing.

- Training and Development: Equipping employees with the skills to leverage new technologies will be essential for maximizing the benefits of advanced forecasting methods.

- Fostering a Culture of Agility: Cultivating a flexible organizational culture that embraces change will be pivotal in adapting to the fast-paced nature of the market.

- Emphasizing Collaboration: Encouraging interdepartmental collaboration will enhance the forecasting process by integrating diverse perspectives and insights.

- Continuous Monitoring: Organizations should establish mechanisms for continuously monitoring market conditions and adjusting forecasts accordingly to remain competitive.

By embracing these strategies, organizations can effectively position themselves for future growth and success in the realm of sales forecasting and financial planning.